Unique Uses Of Trial Balance In Accounting

A trial balance is made in accordance with the double-entry concept of bookkeeping.

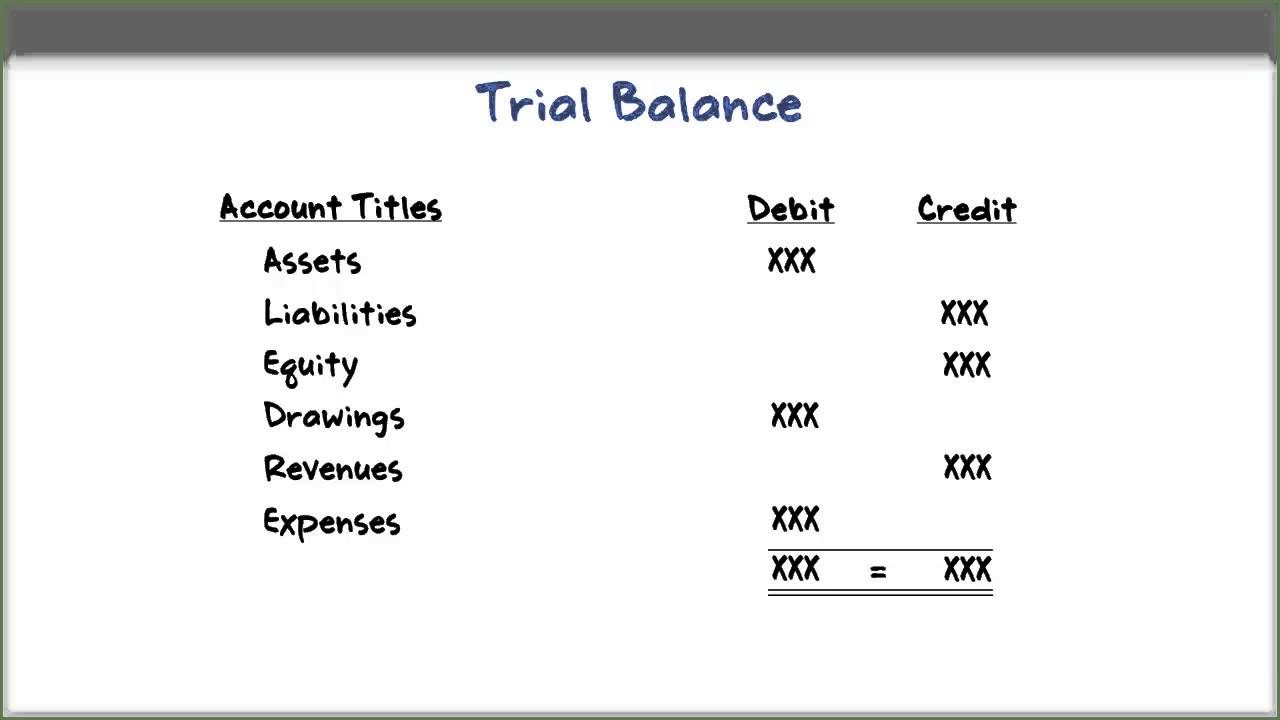

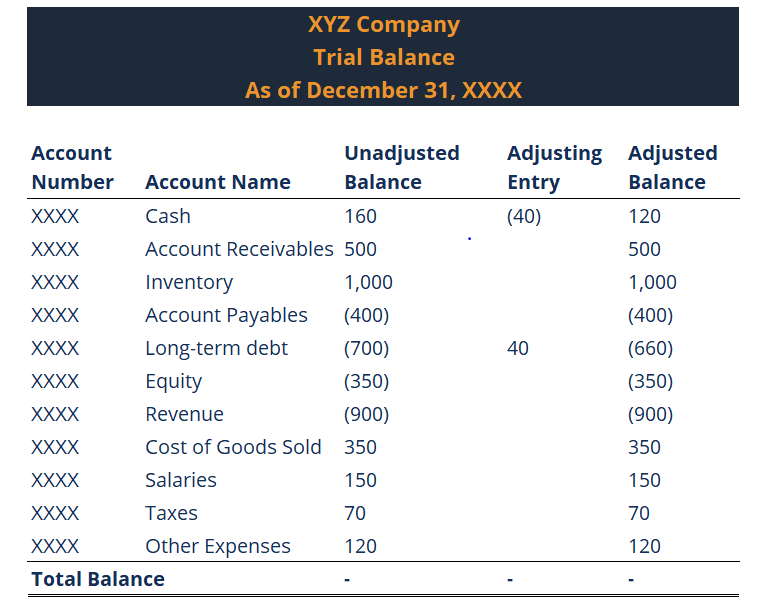

Uses of trial balance in accounting. The total dollar amount of the debits and credits in each accounting entry are supposed to match. The Uses and Characteristics of Trial Balance-Keeping in mind the definition of the trial balance we can define the following characteristics and use of the trial balance-Trial balance is prepared in tabular form only. In addition to error detection the trial balance is prepared to make the necessary adjusting entries to the general ledger.

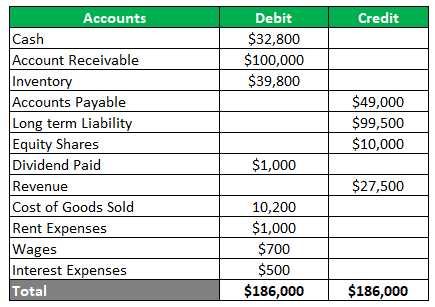

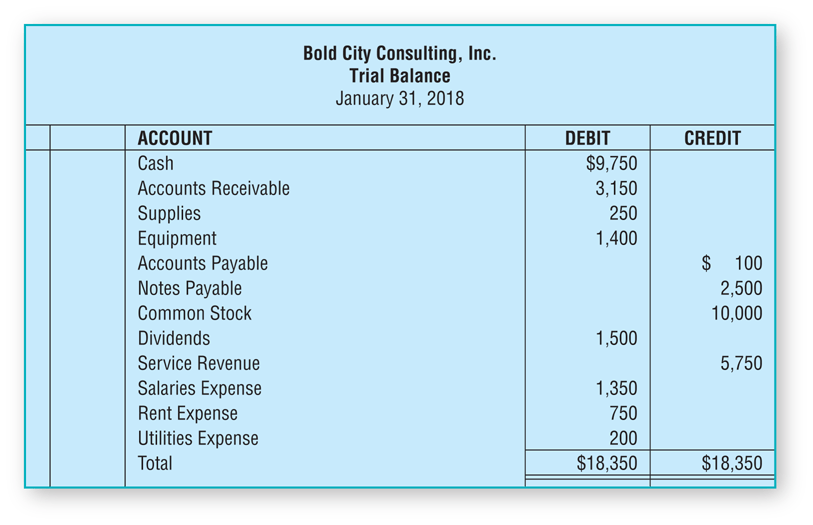

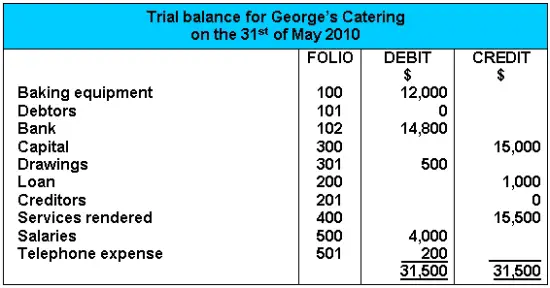

Trial Balance Example 1. Trial Balance aside from general ledger accounts is also useful to check the accuracy of special-purpose. Below is an example of a Companys Trial Balance.

Ad Get Your Trial Balance Template Download Print in Minutes. Double-entry accounting is exactly what it sounds likeequally recording transactions in two or more accounts. It is primarily used to identify the balance of debits and credits entries from the transactions recorded in the general ledger at a certain point in time.

The trial balance is used to verify the actual amount entered on the right side of the current account while migrating the figures from various ledger books like purchase books sales books cash books etc. It is usually prepared at the end of an accounting period to assist in the drafting of financial statements. Your trial balance and general ledger both use double-entry accounting.

Trial Balance is important because of the following points. Purpose of the Trial Balance in Accounting The trial balance is a list of debit and credit balances in the ledger accounts of a business at a given date. How a Trial Balance Works Preparing a trial balance for a company serves to detect any mathematical errors that have occurred in the double-entry accounting system.

Ledger balances are segregated into debit balances and credit balances. A trial balance lists the ending balance in each general ledger account. The trial balance can also be used to manually compile financial statements though with the predominant use of computerized accounting systems that create the statements automatically the report is rarely used for this purpose.