Breathtaking T3 Statement Of Trust Income

But some are surprised to hear they may need to file a return for the estate itselfthe T3 Statement of Trust Income.

T3 statement of trust income. The estate as a trust. On T3 slip look for both boxes in the right side column. From the estate of someone who passed away.

T3 - Statement of Trust Income. Check off T3 slip and continue to T3. These slips show any interest dividend or capital gain income earned.

If youve received a T3. T3Relevé 16 Statement of Trust Income Allocation and Designations The T3Relevé 16 reports various types of income distributed to you from the pools which are set out in different boxes eg Capital Gains Eligible Dividends Non-Eligible Dividends Interest Foreign Non-Business Income etc. You might also receive a T3 if you had investment income from a non-mutual funds in non-registered accounts.

The income may come from your own investments or from an estate trust as inheritance tax. Statement of trust income allocations and designations slip shows income allocated to you as a beneficiary by a trust such as a personal or estate trust. Mutual funds in a non-registered account.

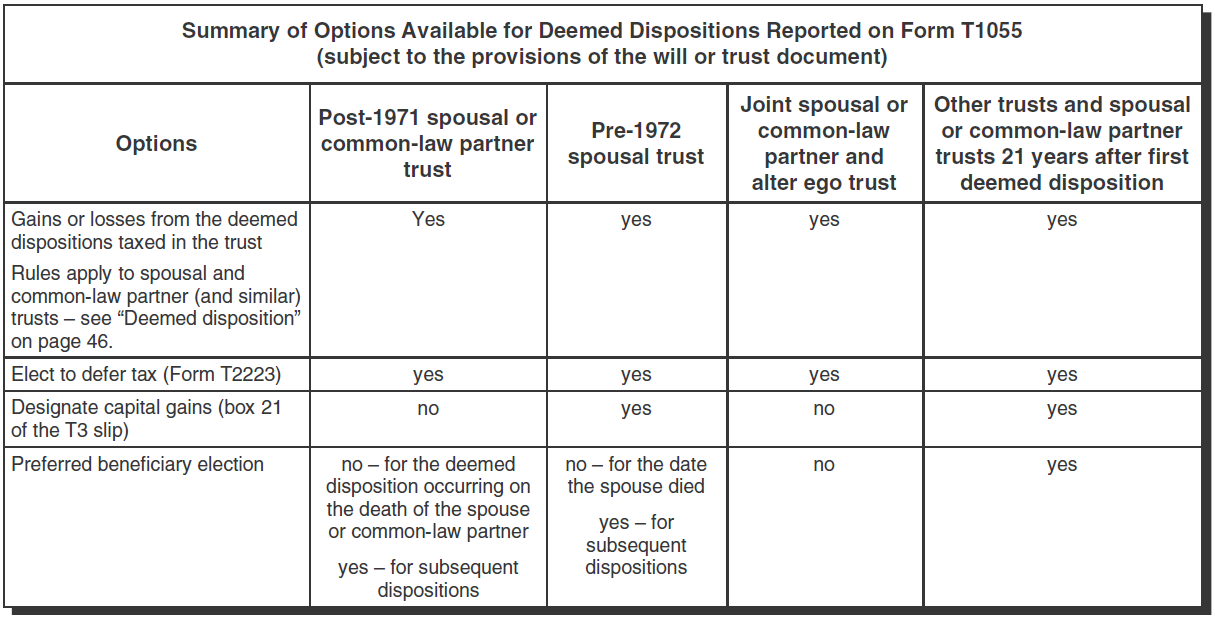

27 rows T3 ñ Statement of Trust Income Allocations and Designations. The T3 Statement of Trust Income Allocations and Designations slip is the tax form that deals with income generated by trusts. You might also receive a T3 if you had investment income from non-mutual funds in non-registered accounts.

In Québec you receive a relevé 16. Trusts are established as a form of legal protection for the creator- or trustor- that preserves their assets while ensuring the distribution of assets according to the trustors wishes. Statement of trust income allocations and designations slip shows income allocated to you as a beneficiary by a trust such as a personal or estate trust.