Unbelievable Moodys Financial Ratio Definitions

Moodys Financial Metrics projection tool allows users to generate estimated quantitative ratings for a single bank and its peers by creating scenarios using scorecards with pre-populated financial data from Moodys Investors Service.

Moodys financial ratio definitions. Ten years of annual and quarterly financial ratios and margins for analysis of Moodys MCO. This cross-sector rating methodology explains Moodys approach to making financial statement adjustments for non-financial corporations. Qualitative adjustments to these ratio-driven scores capturing other relevant financial ratios as well as a range of broader considerations that financial metrics do not necessarily capture.

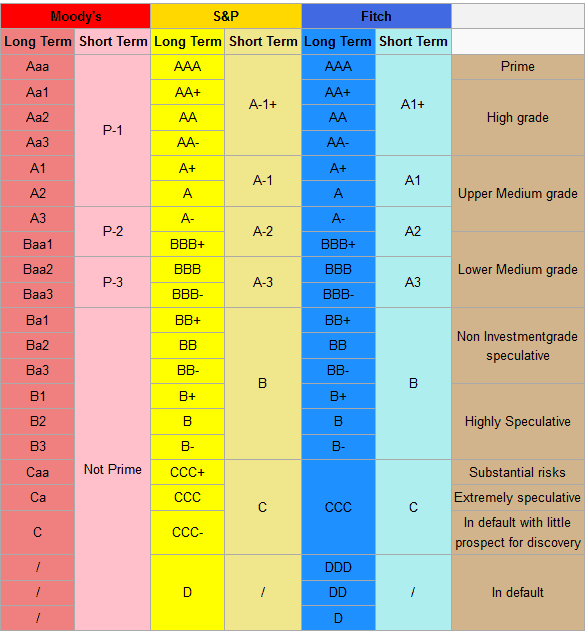

Director Leveraged Finance Credit Suisse First Boston New York and London Equity capital markets and Leveraged Finance JP Morgan New York. Our basic ratios no longer contain complicated add backs to the numerators and denominators but are instead simpler constructs based on fully adjusted sets of financial statements. Moodys rating symbols rating scales and other ratings-related definitions are contained in Moodys Rating Symbols and Definitions publication Moodys Global Long-Term Rating Scale and Global Short-Term Rating Scale contained in the Rating Symbols and Definitions publication are reprinted below.

As such these ratings incorporate Moodys assessment of the default probability and loss severity of the obligations. Moodys FM is a data and analytics platform providing financials and ratios for over 3000 companies. Millersville University of Pennsylvania.

Section I describes details of the data and methodology. They address the possibility that a financial obligation will not be honored as promised. Since John Moody devised the first bond ratings more than a century ago Moodys rating.

Ten years of annual and quarterly financial ratios and margins for analysis of Moodys MCO. As a result a simple monotonic relationship between ratings and any single ratio should not generally be expected. In any event when Moodys does analyze financial ratios it uses a multivariate approach.

Our Scorecard is designed to capture express and explain. The data is adjusted to better reflect the underlying economics and comparability of companies and provides analytical tools that enable a unique insight into credit analysis of corporations. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Moodys Corporations.