Best Gm Financial Ratios

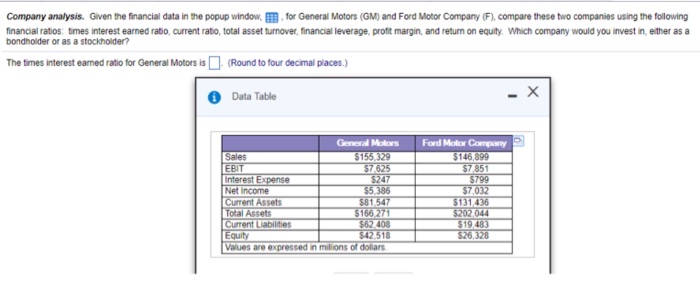

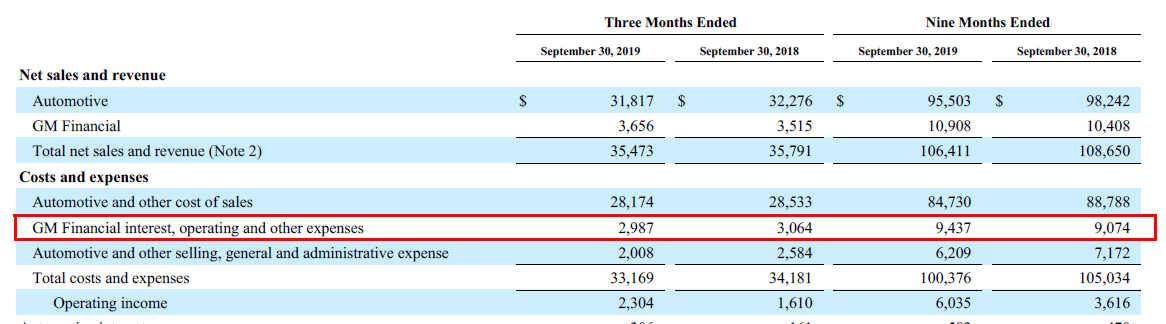

In the next three years their debt ratio would continually climb until it reached 321 in 2018.

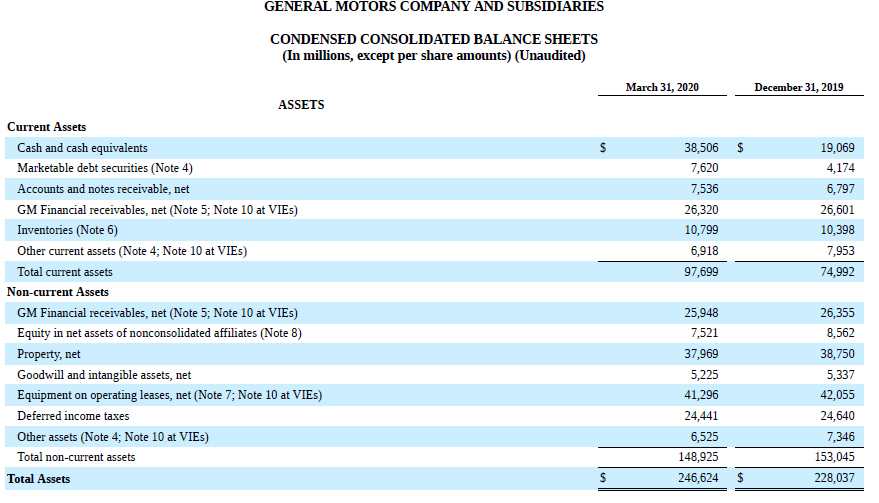

Gm financial ratios. The balance sheet is a financial report that shows the assets of a business ie. General Motors debt ratio is relatively low. Public companies with industry averages.

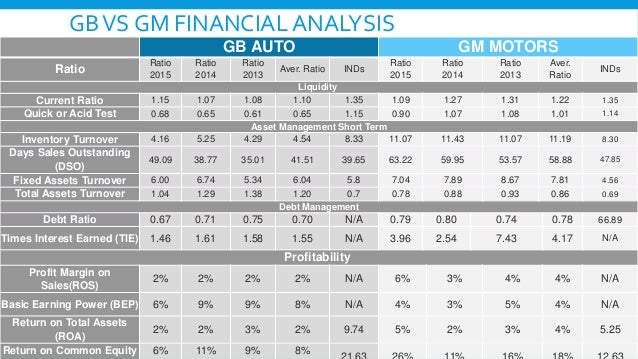

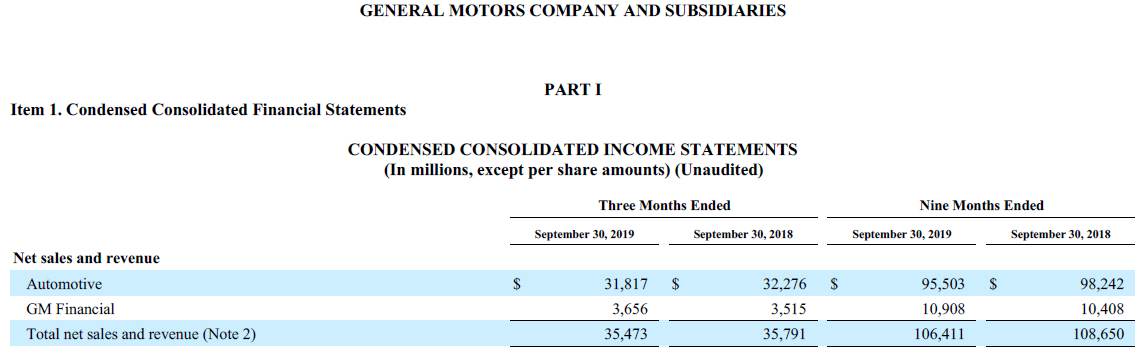

They can serve as useful tools to evaluate GM investment potential. Generally speaking GMs financial ratios allow both analysts and investors to convert raw data from GMs financial statements into concise actionable information that can be used to evaluate the performance of GM over time and compare it to other companies across industries. Short-term Activity Ratios Summary.

Compare financial ratios of 10000 largest US. 21 rows Financial ratios and metrics for General Motors stock GM. Msn back to msn home.

Fusion Media would like to remind you that the. What it owes to others and equity ie. We proudly service customers and dealers with competitive financing and GM lease programs.

There are many standard financial ratios used in order to evaluate a business or a company. General MotorsFinancial ratios are relationships based on a companys financial information. GM Financial provides auto loan financing through auto dealers across the US.

However in 2019 General Motors lower its debt ratio back to 289. Financial ratios are generally ratios of selected values on an enterprises financial statements. GM Financial offers a variety of auto finance options to help you get behind the wheel of a new or used car truck or SUV and we look beyond your credit score to make a decision.