Wonderful A Projection Of Anticipated Cash Flows

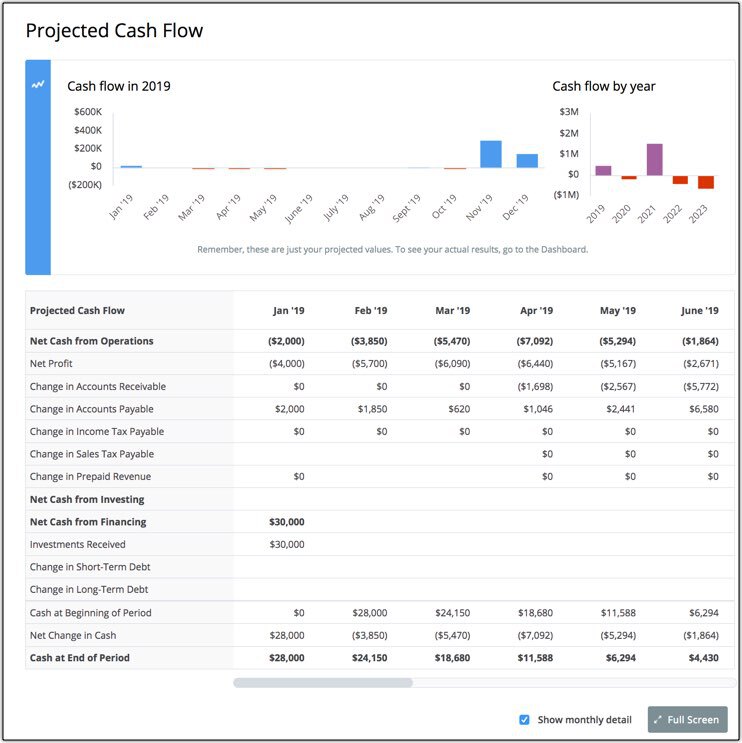

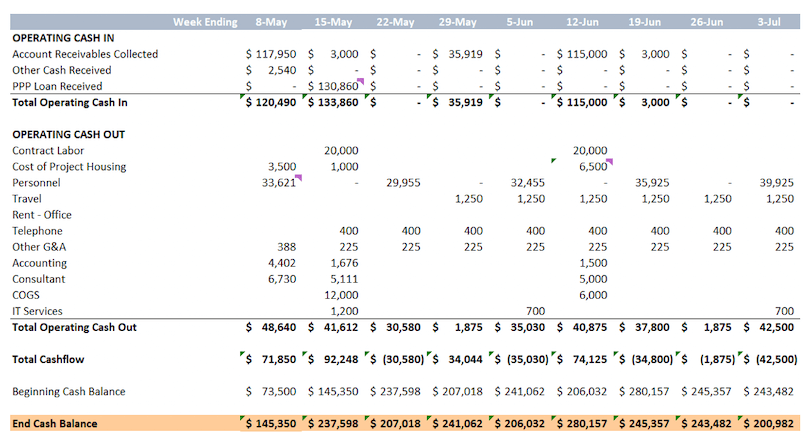

It is usually prepared on a monthly basis but that can be reduced to a shorter period of say a week and.

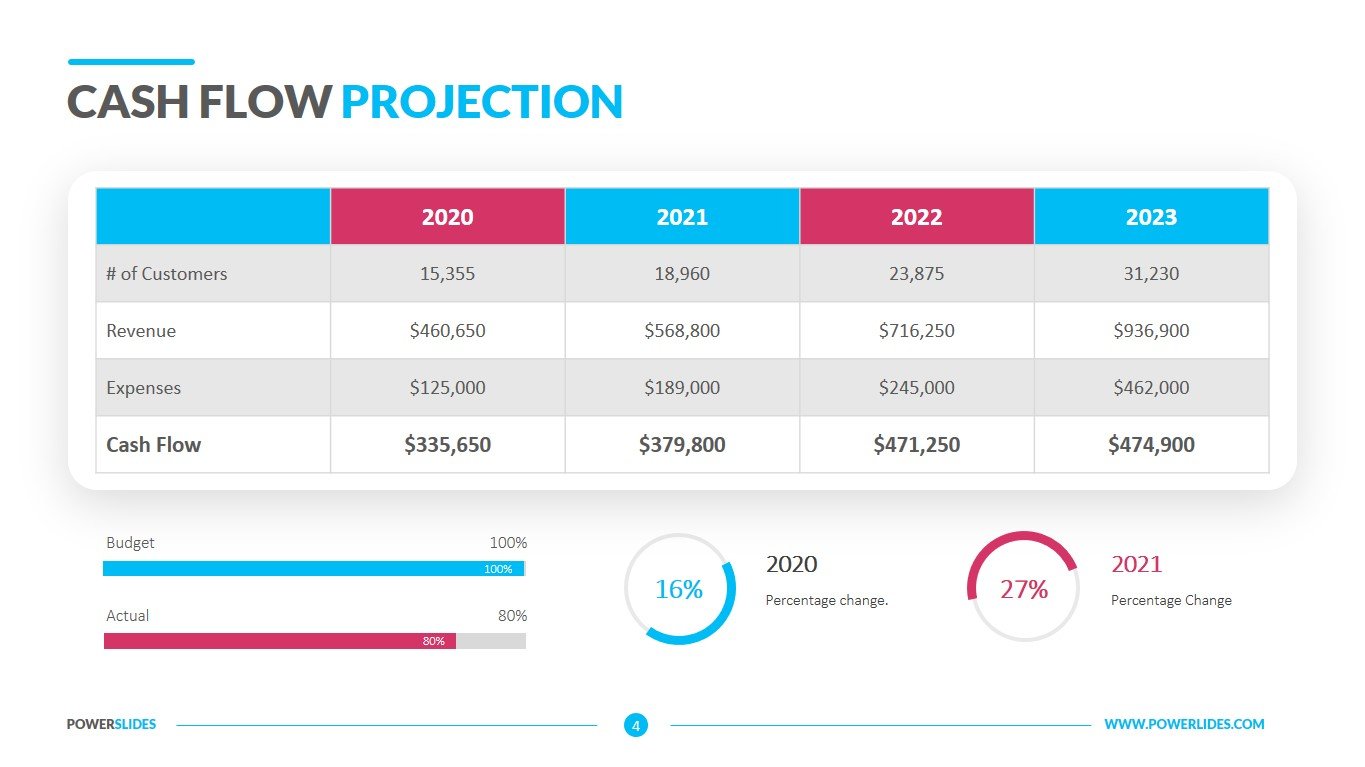

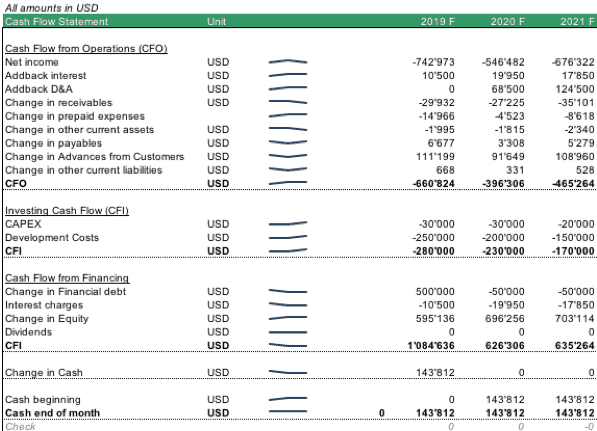

A projection of anticipated cash flows. Typically most businesses cash flow projections cover a 12-month period. The key reasons why a cash flow projection is important is to identify potential shortfalls in cash balances earlier consider the income forecast as an early warning system. Sarbanes-Oxley Act SOX Law that requires publicly traded companies to maintain adequate systems of internal control.

A business must make certain that it can afford to pay suppliers and employees. A cash flow projection estimates the money you expect to flow in and out of your business including all of your income and expenses. But unlike your budget it deals only with cash transactions over a specified period of time.

A cash flow projection estimates the money you expect to flow in and out of your business including all of your income and expenses. Most organizations create cash flow projections for a 12-month period of time. Cost of goods sold.

G A projection of anticipated cash flows H Insurance protection against G a projection of anticipated cash flows h insurance School Strayer University Birmingham. Cash flow forecasting is essential because of the breakdown of anticipated receivables than payables. For the purpose of this projection cash funds are defined as cash checks or money order paid out or received.

Cash equivalents Short-term highly liquid investments that can be readily converted to a specific amount of cash and which are relatively insensitive to interest rate changes. And this cash flow projection template is very useful it tell us the cash position of the firm this statement is made inside the company by the accountant or finance managers of the company to check the company cash position cash is the liquid asset. A cash flow projection also referred to as a cash flow forecast is essentially a breakdown of expected receivables versus payables.

It ultimately provides an overview of how much cash the business is expected to have on hand at the end of each month. In this the future projections are made for the cash inside the company. Such a forecast typically takes less than an hour.