Fabulous Depreciation Entry In Profit And Loss Account

The accounting for depreciation requires an ongoing series of entries to charge a fixed asset to expense and eventually to derecognize it.

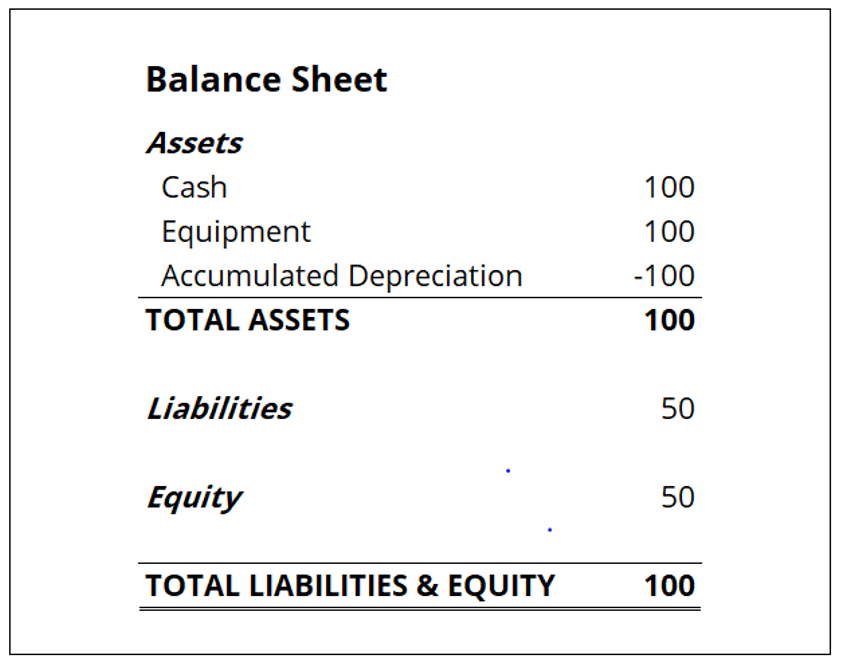

Depreciation entry in profit and loss account. Journal Entry for Depreciation Reduction in the value of tangible fixed assets due to normal usage wear and tear new technology or unfavourable market conditions is called Depreciation. Depreciation Account is taken to the Profit and Loss Account and the asset at its reduced value is shown in the Balance Sheet. There are many methods for calculating depreciation expense but the famous areas.

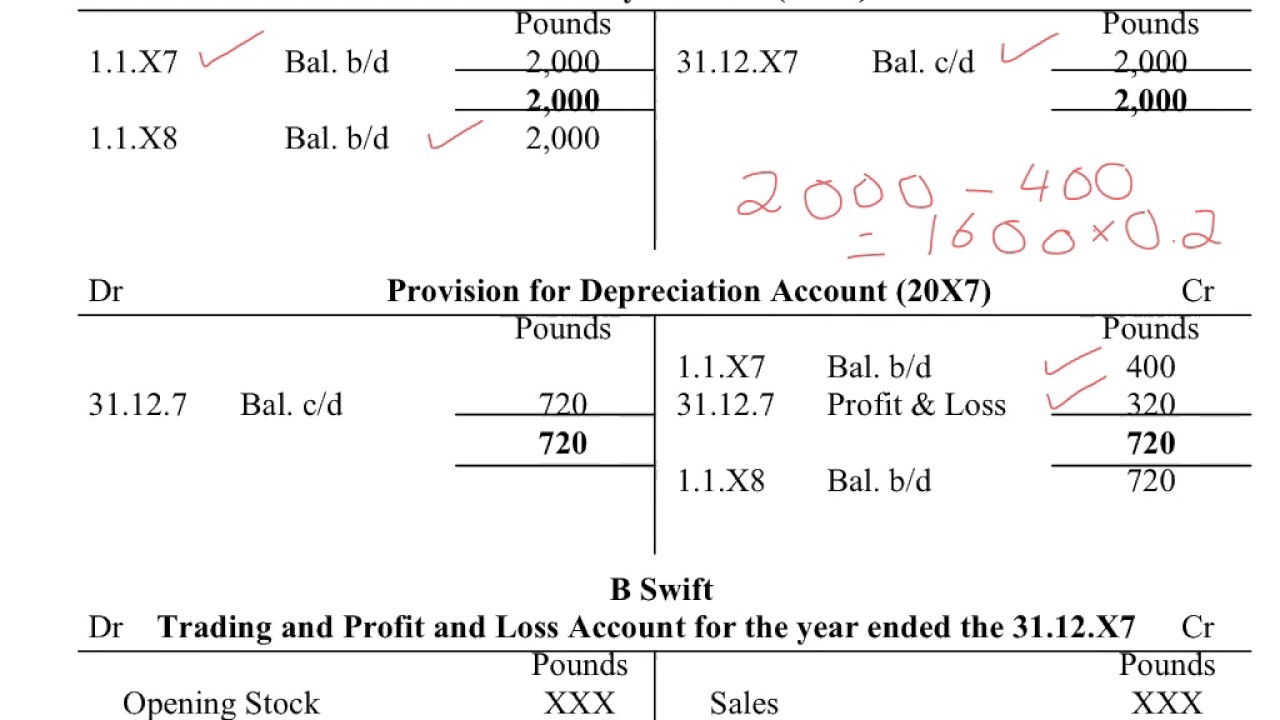

To Profit and Loss Account This entry will close the Profit and Loss Account. Depreciation is an expense which is charged in the current years income statement. The balance of the provision for depreciation account is carried forward to the next year.

Note that the provision on depreciation account is not a. The expense reduces the amount of profit. When the asset is sold during its useful life the depreciation should be charged for the period the asset is used in the year of sale.

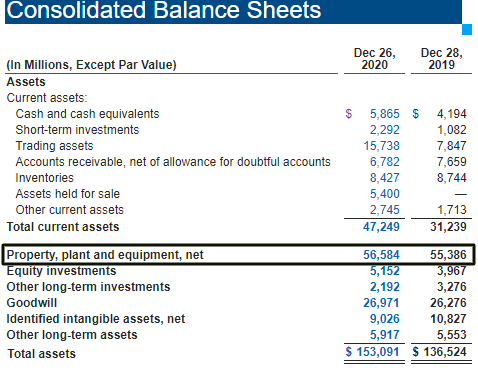

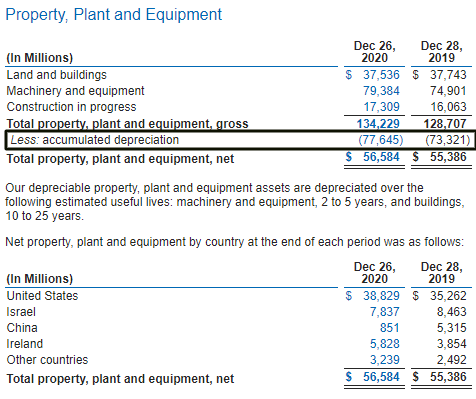

The value of depreciation is deducted from assets value the result gives us the NETBOOK VALUE. The value of depreciation is posted to the profit and loss account as expenses. PPE Property Plant and Equipment PPE Property Plant and Equipment is one of the core non-current assets found on the balance sheet.

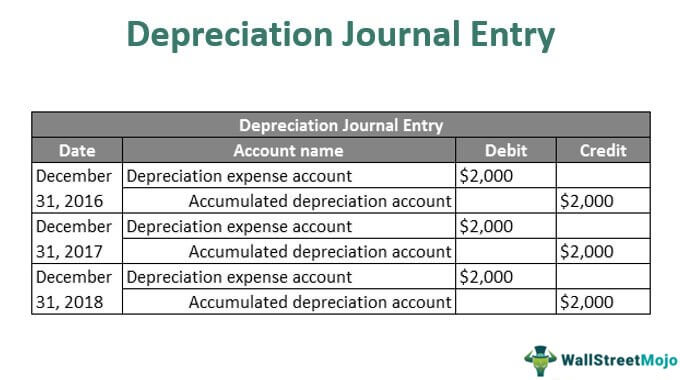

Provision for Depreciation Account which is an expense account used to record depreciation each period An Accumulated Depreciation Account used to show aggregated depreciation The Income Statement Profit and Loss Account The entries are two fold. The balance in depreciation expense account is transferred to the profit and loss account at the end of the year. Depreciation is instead recorded in a contra asset account namely provision for depreciation or accumulated depreciation.

Journal entry for depreciation depends on whether the provision for depreciationaccumulated depreciation account is maintained or not. Entries required to make the Trading Account and the Profit and Loss Account are known as Closing Entries because their effect is to close the books of account for the year concerned. When a business has a disposal of fixed assets the original cost and the accumulated depreciation to the date of disposal must be removed from the accounting records.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)