Out Of This World General Motors Financial Ratios

Generally speaking GMs financial ratios allow both analysts and investors to convert raw data from GMs financial statements into concise actionable information that can be used to evaluate the performance of GM over time and compare it to other companies across industries.

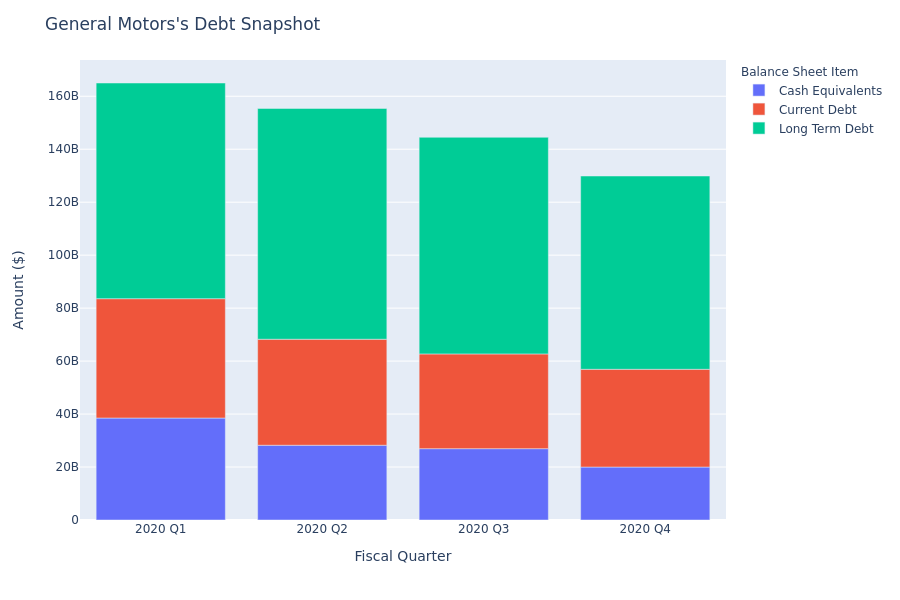

General motors financial ratios. Starting in 2015 its debt ratio was 224. View GM financial statements in full. A liquidity ratio calculated as cash plus short-term marketable investments plus receivables divided by current liabilities.

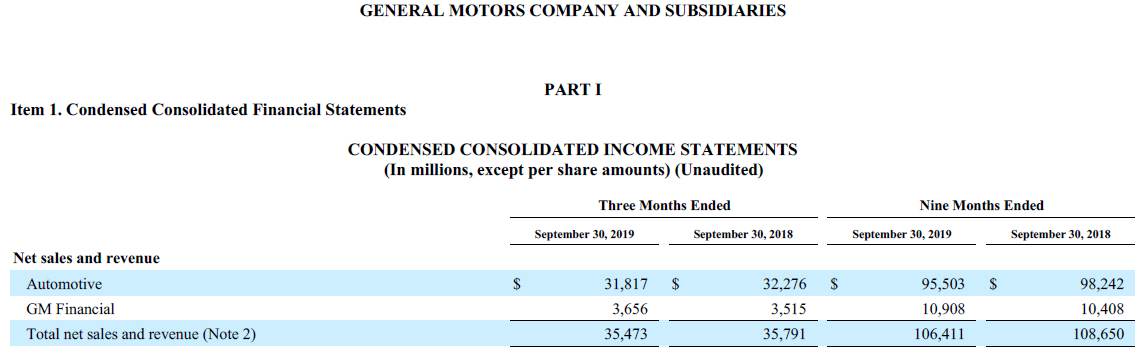

General MotorsFinancial ratios are relationships based on a companys financial information. The United States now has four brands instead of eight under old GM. Net incomeapplicable to common stockholders increased from.

The financial condition of General Motors Financial Company Inc in 2020 is better than the financial condition of half of all companies engaged in the activity Finance Services Comparison of the Companys financial ratios with average ratios for all. Balance sheet income statement cash flow earnings estimates ratio and margins. The revenue growth rate was -23 in FY2015 and 03 in FY2014.

Sales to revenue ratio. Short-term Activity Ratios Summary. The financial condition of General Motors Company in 2020 is worse than the financial condition of half of all companies engaged in the activity Motor Vehicles and Passenger Car Bodies The average ratios for this type of business activity are higher than the average for all industries.

Ten years of annual and quarterly financial ratios and margins for analysis of General Motors GM. A liquidity ratio calculated as current assets divided by current liabilities. In the next three years their debt ratio would continually climb until it reached 321 in 2018.

GM has eight brands and operates under four segments. Analysis of Short-term Operating Activity Ratios Evaluates revenues and output generated by the General Motors Cos assets. General Motors However we cannot use the operating margin as the only financial ratio in a valuation.