Outrageous Statement Of Functional Expenses Example

If your nonprofit is required to prepare a statement of functional expenses our form provides the layout.

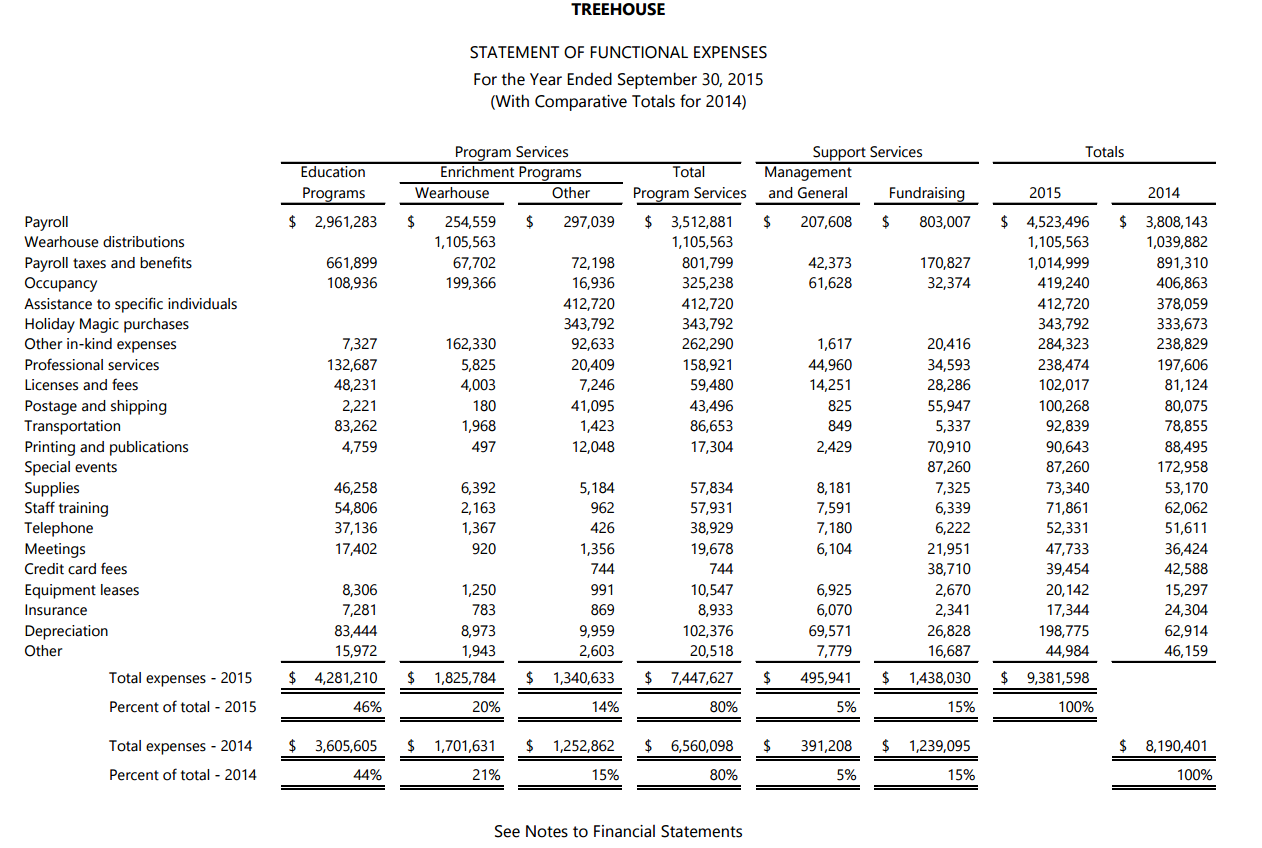

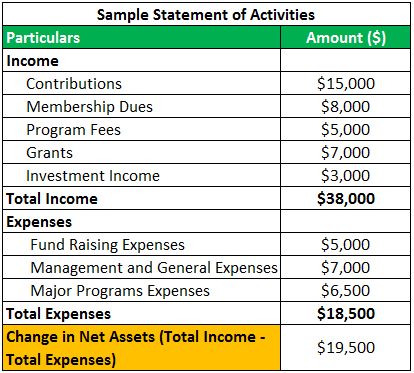

Statement of functional expenses example. Generating a Statement of Functional Expense similar to the attached example can be challenging if you dont have proper accounting software to support it. So after costs they net only 15000 on the mailing. Presentation of Financial Statements of Not-for-Profit Entities.

For instructional purposes we highlighted the column headings to indicate the expenses. 1 Program Services 2 Management and General 3 Fundraising Program services may include a single service or several separate identifiable services. With FASBs issuance of Accounting Standards Update ASU 2016-14 Not-for-Profit Entities Topic 958.

What Is Functional Expense Allocation. Statement Of Functional Expenses Relied upon to assess management quality and financial management Detailed breakdown of expenses Expenses as defined by the IRS not GAAP Three functional expense categories Program service Management and general Fundraising 23 natural categories and other 9. They also prove to the IRS and your donors that your nonprofit has a system of checks and balances to stay in compliance.

Column A Every expense should be listed here. Examples of expenses that would be allocated to non-MG functions CEOs time ie. Management and general expenses are necessary to operate an effective organization.

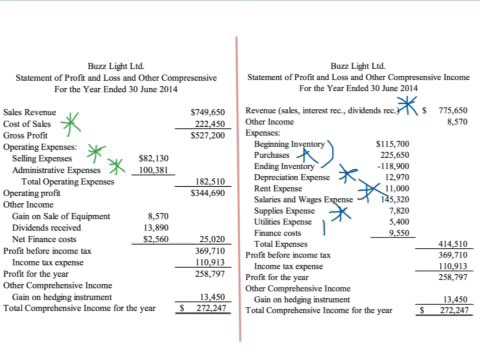

FUNCTIONAL EXPENSE REPORTING There are three Functional Expense Categories. Our forms are educational as well as time savers. The use of function method to disclose expenses still requires us to disclose the individual expenses by nature method under each function either on the face of the income statement or in the notes to the income statement.

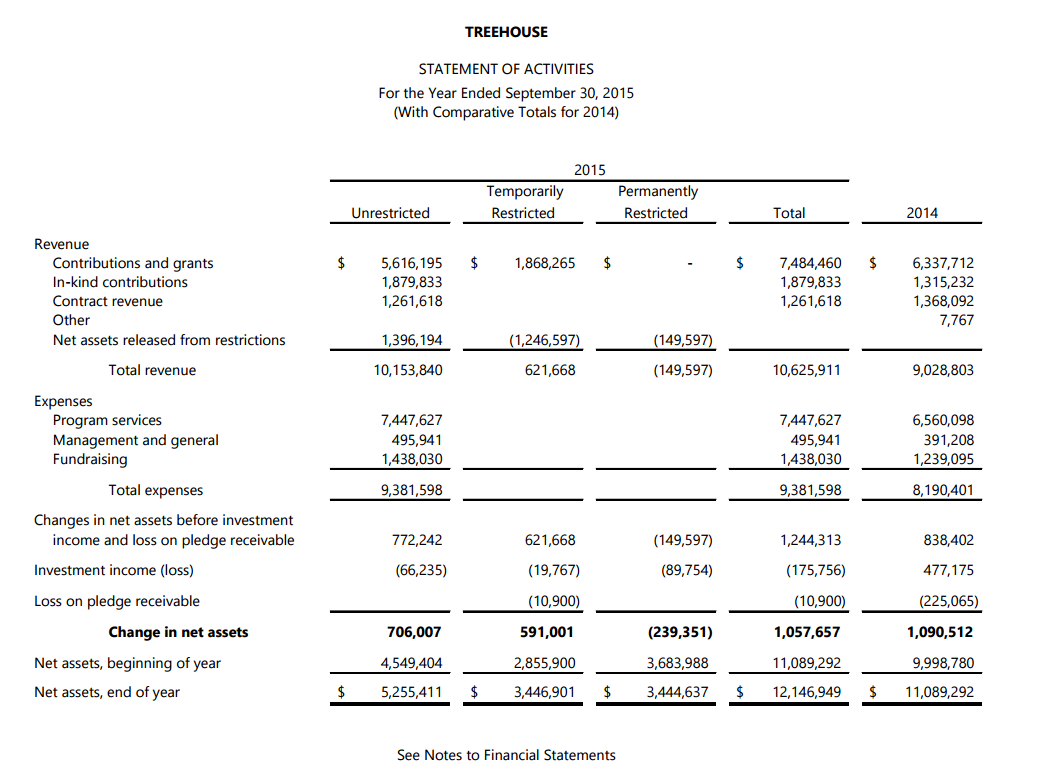

If the cost of the mailing is fully allocated to fund raising expense it would appear that only 38 of raised funds go to program purposes 1500040000. The costs of providing various programs and other activities have been summarized on a functional basis in the statements of activities and in the statements of functional expenses. For some not-for-profit entities NFPs a separate statement of functional expenses will be the most efficient and effective way of presenting the analysis of expenses by function and nature that is required under FASB Accounting Standards Update ASU 2016-14 Not-for-Profit Entities Topic 958.