Wonderful Ifrs 10 Acca

Obtaining this qualification will raise your.

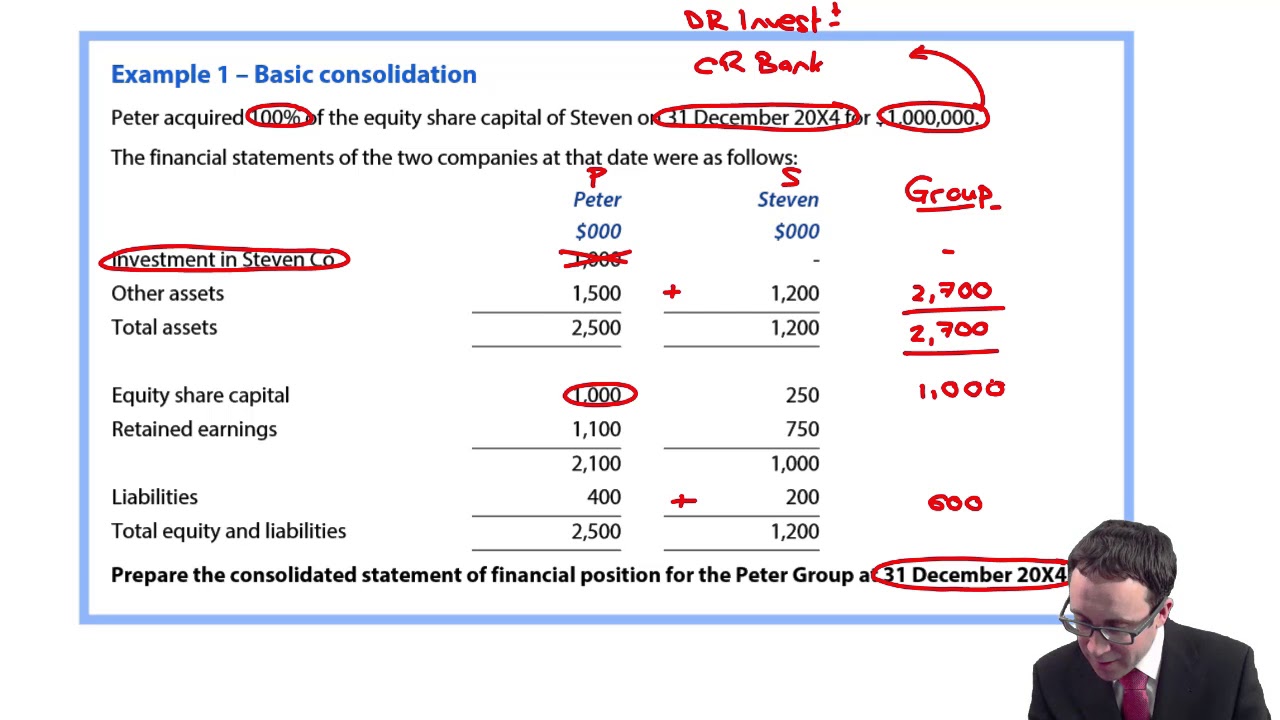

Ifrs 10 acca. IFRS 10 establishes principles for presenting and preparing consolidated financial statements when an entity controls one or more other entities. IFRS 10 Consolidated Financial Statements. Leases IFRS 16 Chapter 13.

IFRS 12 Disclosure of Interests in Other Entities. IFRS 10 uses control as the single basis for consolidation and requires that all three of the following are in place in order to establish control and so consolidate an investee. It has investors that are not related parties of the entity.

It has more than one investment. Earnings per share IAS 33. Out of these the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website.

Income taxes IAS 12 Chapter 16-18 no tests. IFRS 11 Joint Arrangements. One unit is the equivalent of one hour of.

This e-learning course is part of an e-learning series designed by PwC Academy which aims to provide a comprehensive overview of the application of IFRS IAS standards to finance and accounting experts who are already familiar with fundamental local accounting and reporting processes. Agriculture IAS 41 Chapter 11. Adjusting events are those providing evidence of conditions existing at the end of the reporting period whereas non-adjusting events are indicative of conditions arising after the reporting period the latter being disclosed where material.

Inventory IAS 2 Chapter 10. This course is made up of videos questions and additional reading materials and accounts for 1 unit of CPD. IFRS 10 is applicable to annual reporting periods beginning on or after 1 January 2013 IFRS 10C1.