Simple Negative Equity Balance Sheet Retained Earnings

The purpose of retaining these earnings can be varied and includes buying new equipment and machines spending on research and development or other activities that could potentially generate growth for.

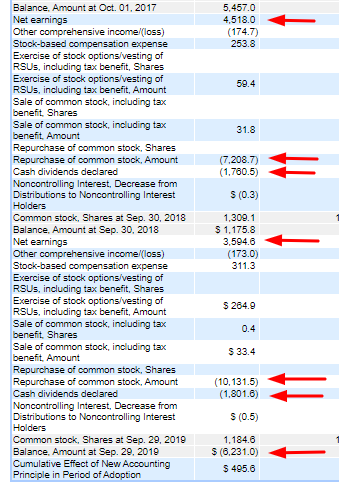

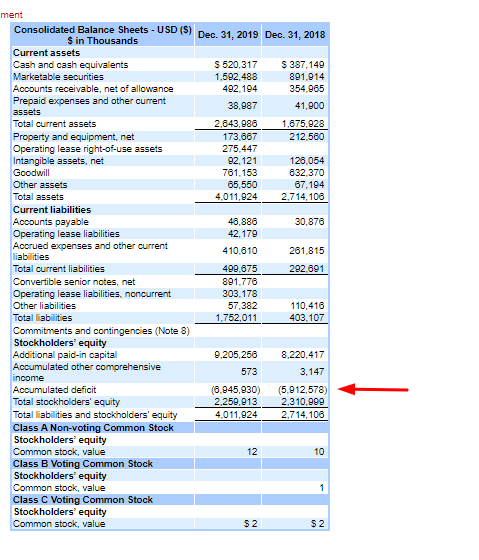

Negative equity balance sheet retained earnings. Positive retained earnings indicate a commitment to overall growth whereas negative retained earnings are indicative of net loss and an accumulated deficit. As the company becomes profitable the roll-forward of corporate profits will increase the retained earnings balance and bring it. Negative retained earnings are a common occurrence for startups and unprofitable companies.

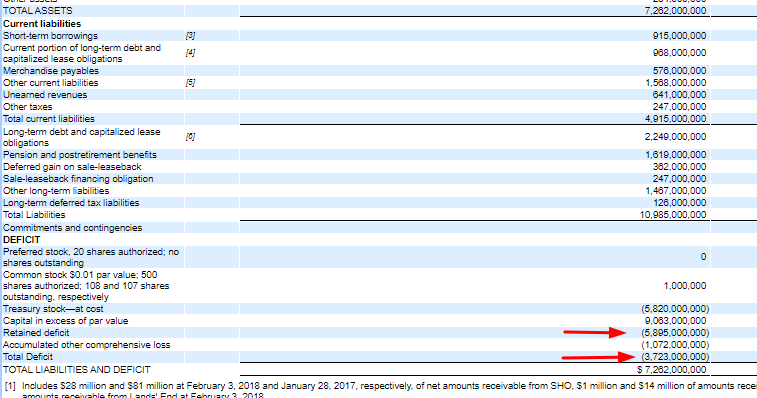

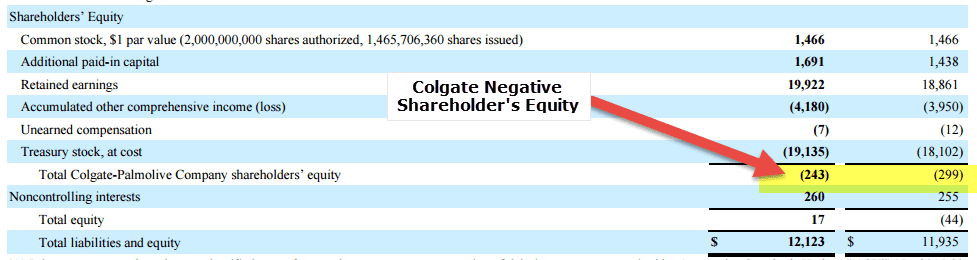

A negative retained earnings balance is usually recorded on a separate line in the Stockholders Equity section under the account title Accumulated Deficit instead of as retained earnings. The owners drawing account in a sole proprietorship will have a debit balance. Hence if it is reported as a separate line it is reported as a negative amount since the owners equity section of the balance sheet normally has credit balances.

If a company operates at a net loss the net losses will result in a negative retained earnings account on the balance sheet. These are special equity accounts created by QuickBooks and exist on the balance sheet. When a company has a negative retained earnings balance it says to the world that it has generated accounting losses over a.

Youll find the retained earnings listed under shareholders equity also called stockholders equity. A company with negative retained earnings is said to have a deficit. When earnings are retained rather than paid out as dividends they need to be accounted for on the balance sheet.

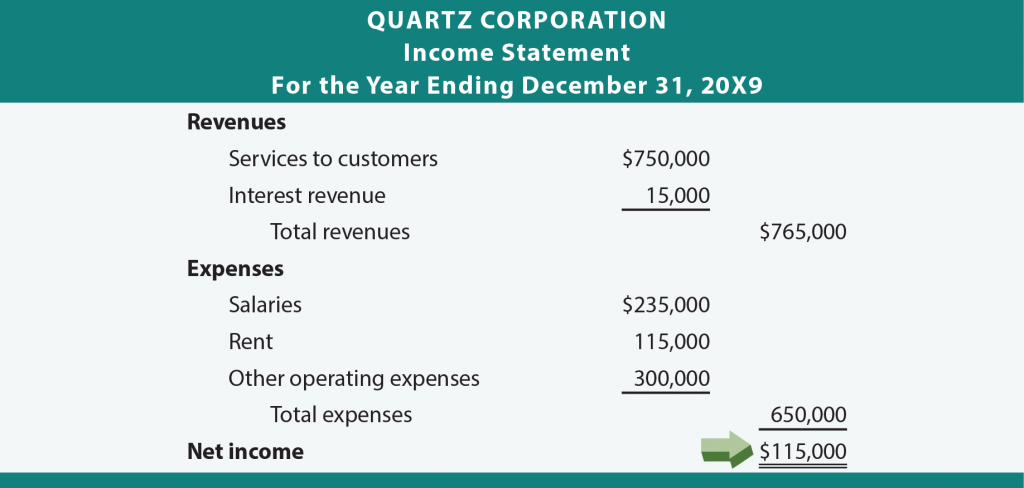

If a company just started operating this number will equal to zero. This negative or positive amount of retained earnings is reported as a separate line within stockholders equity. Warren Buffet recommended creating at least 1 in market value.

Its in the balance sheet above. As you see in the above snapshot there is a huge amount of negative retained earnings accumulated deficit in the Revlon balance sheet which is leading to negative total equity. It does not have any money in retained earnings so it cannot pay out a dividend.

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)