Glory Ifrs For Investment Funds

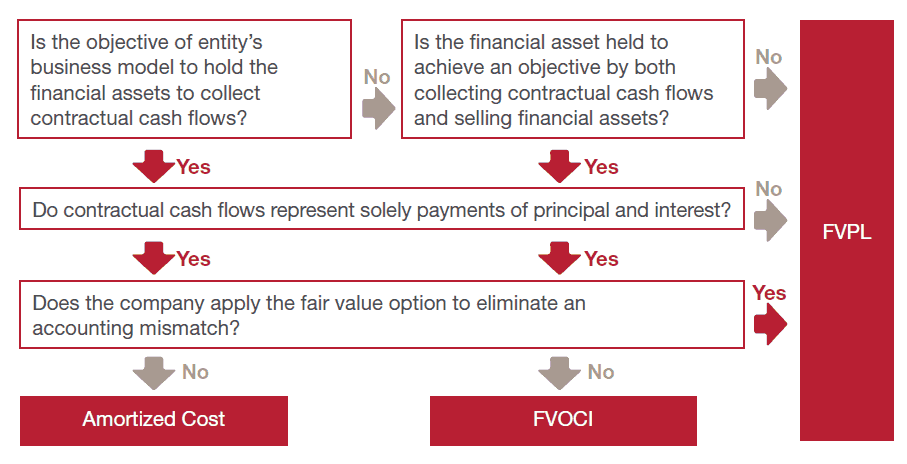

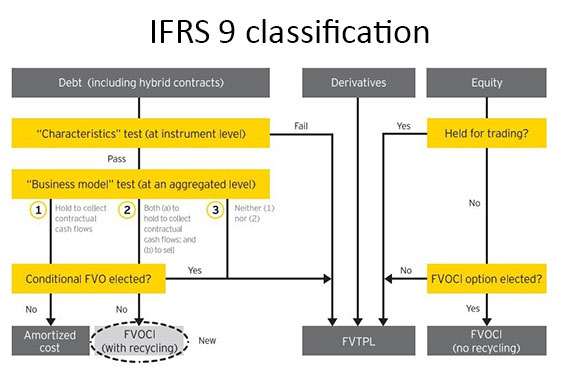

Initial measurement of financial instruments Under IFRS 9 all financial instruments are initially measured at fair value plus or minus in the case of a financial asset or financial liability not at fair value through profit or loss transaction costs.

Ifrs for investment funds. If a fund manager were to consolidate additional funds under IFRS 10 the fund manager may also have to consider implications regarding the sufficiency of a fund managers regulatory capital and other regulatory reporting requirements. The Fund is outside the scope of IFRS 8 Operating Segments. As the scope of IFRS 8 is broader than the scope of the previous IAS 14 and minimum disclosures are required also for entities with only.

Depending on the underlying exposure this can lead to a strategic disadvantage compared to a direct investment in these assets. This requirement is consistent with IAS 39. Investing Just Now The new revenue recognition standard IFRS 15 may change the way investment managers account for non-refundable up-front fees and variable fees.

In this guide the Funds redeemable shares are classified as financial liabilities and the management shares meet the definition of equity. Harnessing the forces of change IFRS for Investment Funds 1 As the activities of investors companies and markets become increasingly global use of a single set of high-quality global standards will help provide investors with the comparable financial information they need to make informed decisions about investment opportunities around the world. The Fund is a fictitious open-ended investment fund incorporated and listed in a fictitious country within Europe.

In this guide the Funds redeemable shares are classified as financial liabilities and the management shares meet the definition of equity. IFRS for Investment Funds This course covers in detail IFRS bound to Investment funds and asset management. IFRS for Investment Funds Financial Instruments Disclosure.

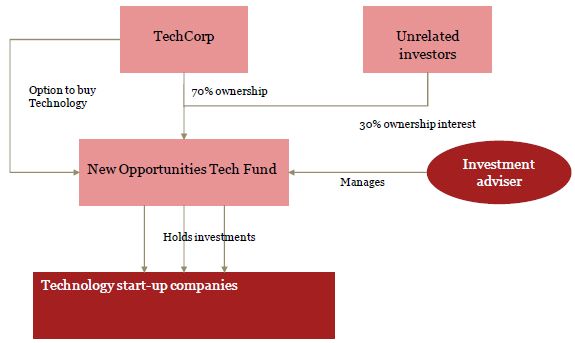

Appendix I illustrates example disclosures for an investment fund that is an investment entity and measures its subsidiaries at fair value through profit or loss FVTPL. European collective investment funds and asset managers released a paper discussing the application of IFRS to investment fundsThe paper noted that most European jurisdictions do not apply IFRS to investment funds. IFRS for Investment Funds publications addresses practical application issues that investment funds may encounter when applying IFRS.

ABC Fund is an existing preparer of IFRS financial statements. Financial Reporting Standards IFRS for a fictional open-ended investment fund ABC Fund or the Fund. It does not have any subsidiaries associates or joint ventures.