Sensational Provision For Doubtful Debts In Income Tax

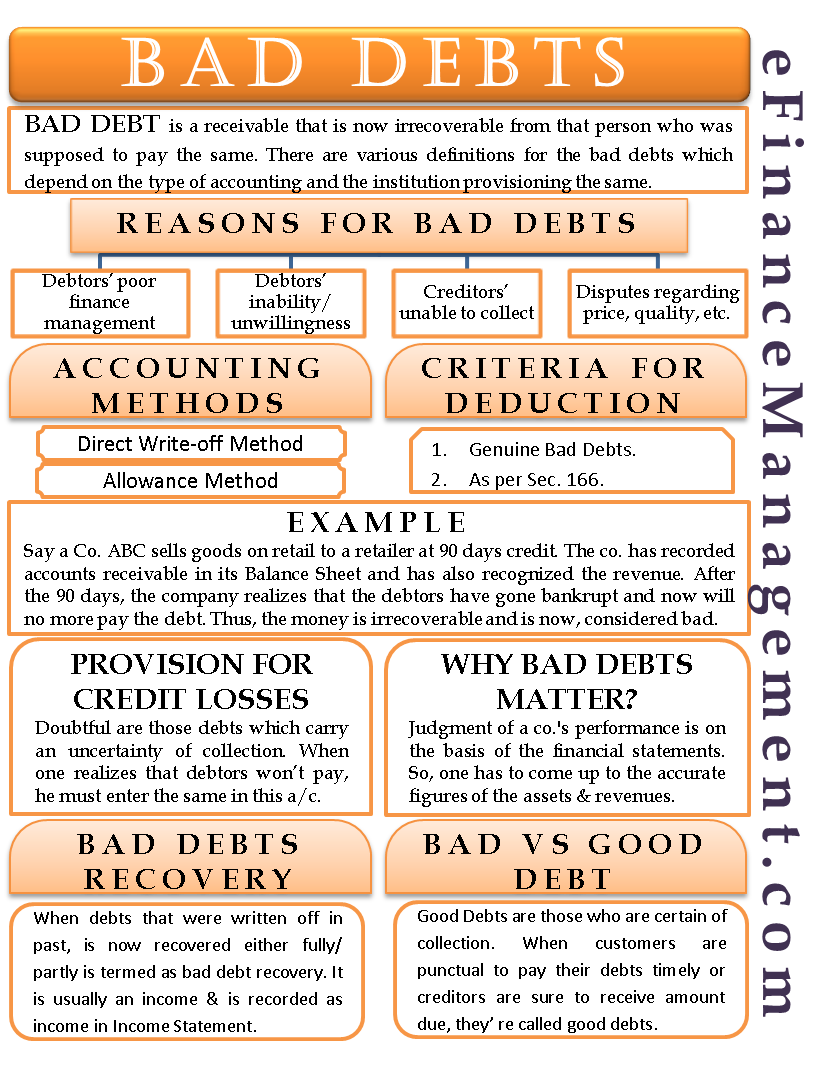

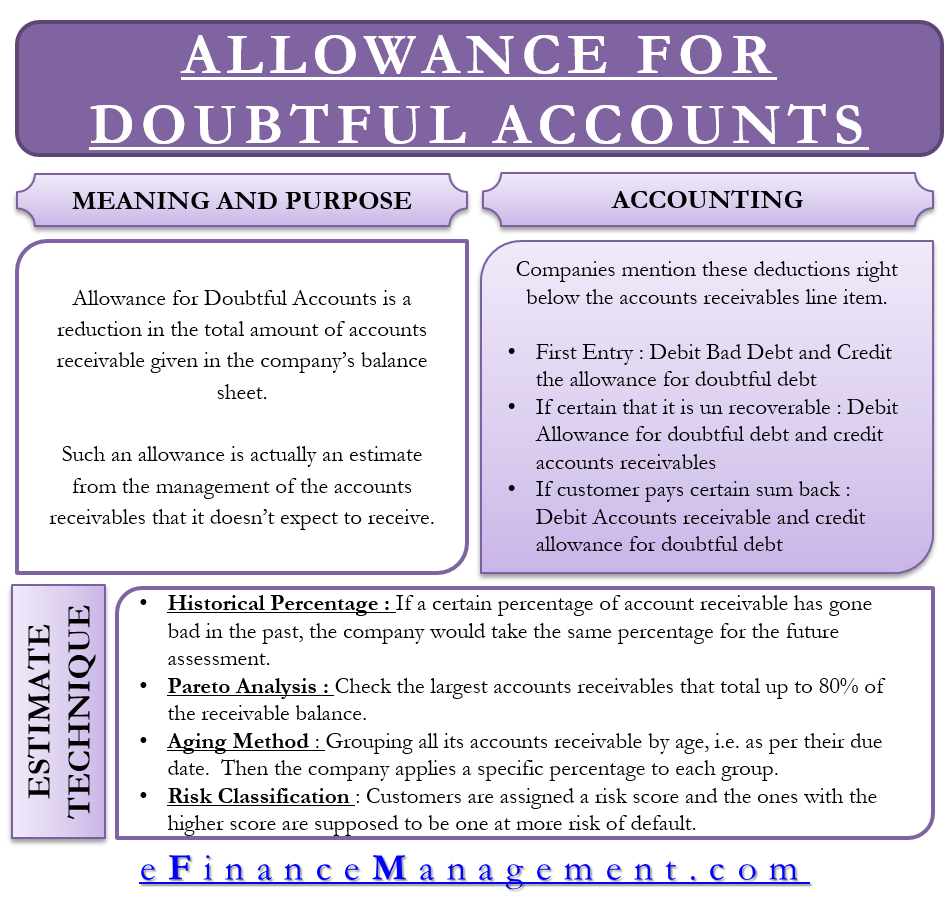

When the debt becomes doubtful the lender is entitled to deduct an allowance.

Provision for doubtful debts in income tax. Ad Find Income Tax Debt. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. Provision for Bad and Doubtful Debts As per section 36 1 viia of the Income Tax Act 1961 only banks and financial institutions are allowed deduction in respect of the provisions made for bad and doubtful debts.

When increase then expense deducted from profit and when decrease then income added in profits. It is identical to the allowance for doubtful accounts. No other assessee is allowed to claim the deduction on the provision of bad debts.

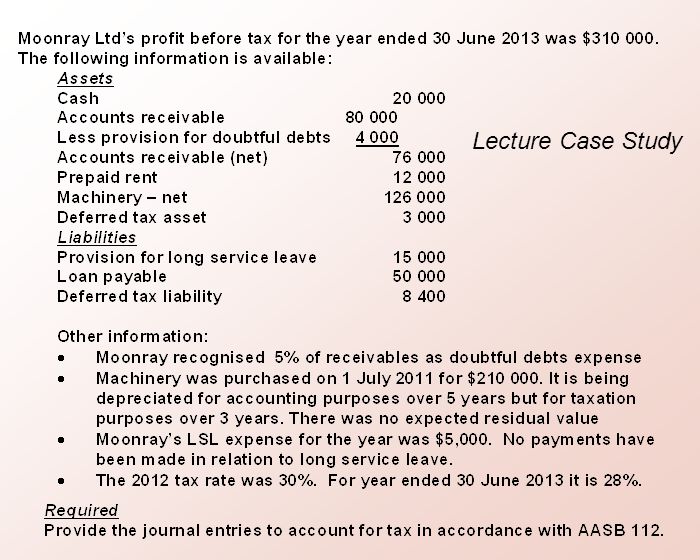

New doubtful debts regime The provisions of section 11j of the Income Tax Act the Act allow for taxpayers to claim tax relief in respect of doubtful debts. 40144027-with provision of Rs. As such the assessees claim us 36 i vii is not tenable.

In 2014 income tax return the taxpayer claimed a doubtful debt allowance of R15000. This amount was arrived at by aggregating the provision for bad and doubtful debts of Rs. 223 Crores on standard assets.

Section 36 1 vii of the Income-tax Act 1961 deals with the allowability of bad debts and section 36 1 viia deals with the allowability of provision for bad and doubtful debts. As per the assessee the actual provision for bad and doubtful debts came to Rs. If the debt ultimately becomes bad the lender is entitled to deduct the amount that became bad.

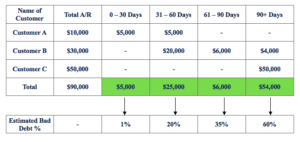

3 General Provision For Bad Debts General provision for bad debts which is based on a percentage of total sales or outstanding debts is not tax deductible even though the taxpayer may be required to do so under law and accounting convention. If provision for doubtful debts balance in 2015 was R120000 2014. R60000 relating to a specific debtor.