First Class At&t Cash Flow Statement

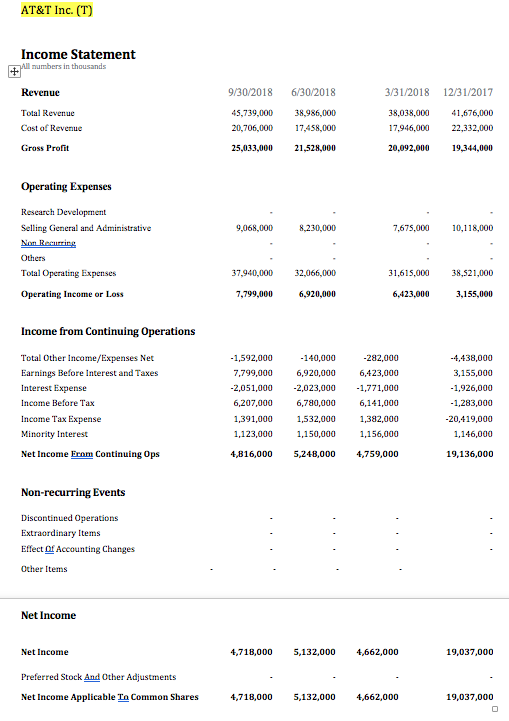

Investors should almost always look for trends in cash flow indicators such as as it is a great indicator of ATT ability to facilitate future growth repay debt on time or pay out dividendsFinancial Statement Analysis is way more than just reviewing and evaluating ATT Inc.

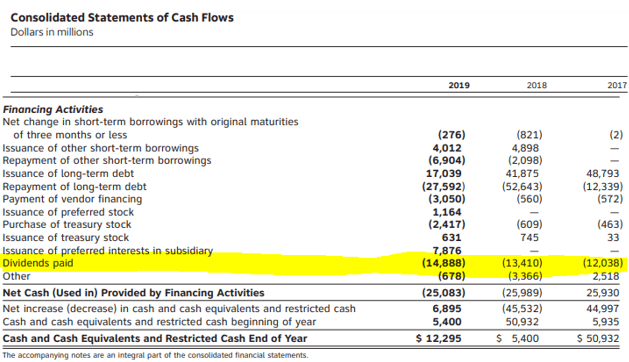

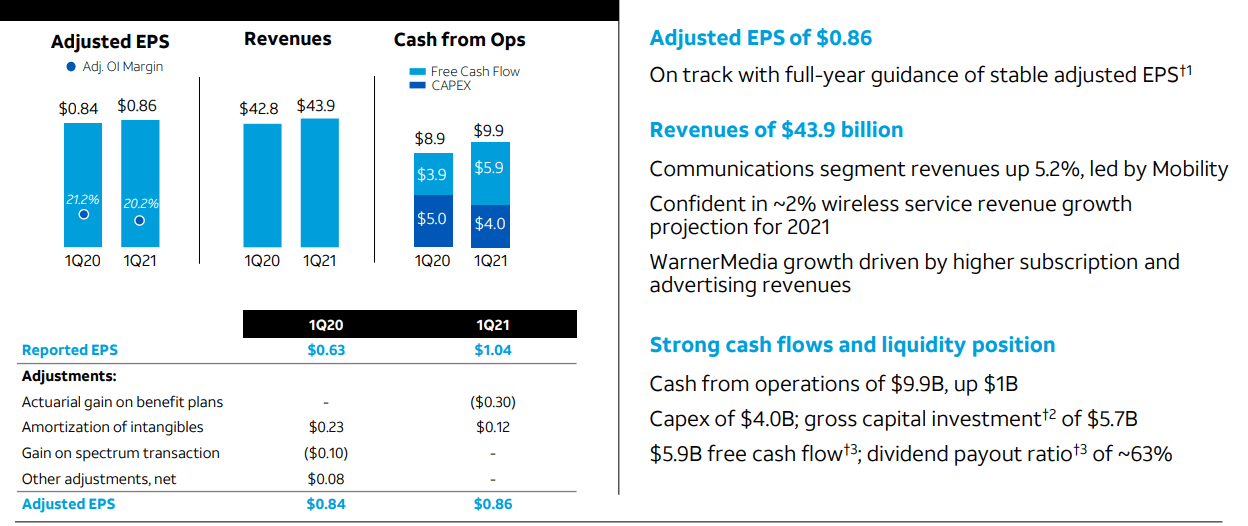

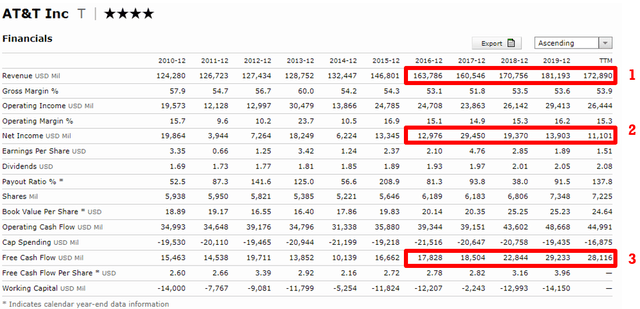

At&t cash flow statement. ATT annual free cash flow for 2019 was 29033B a 299 increase from 2018. ATT free cash flow for the twelve months ending March 31 2021 was a year-over-year. Annual cash flow by MarketWatch.

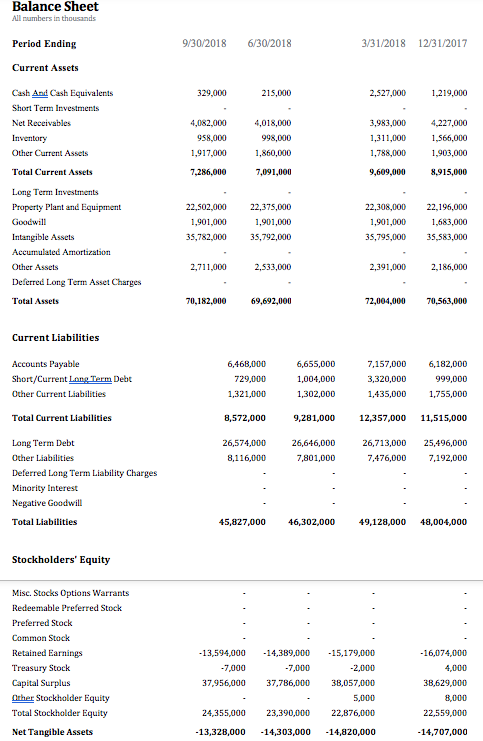

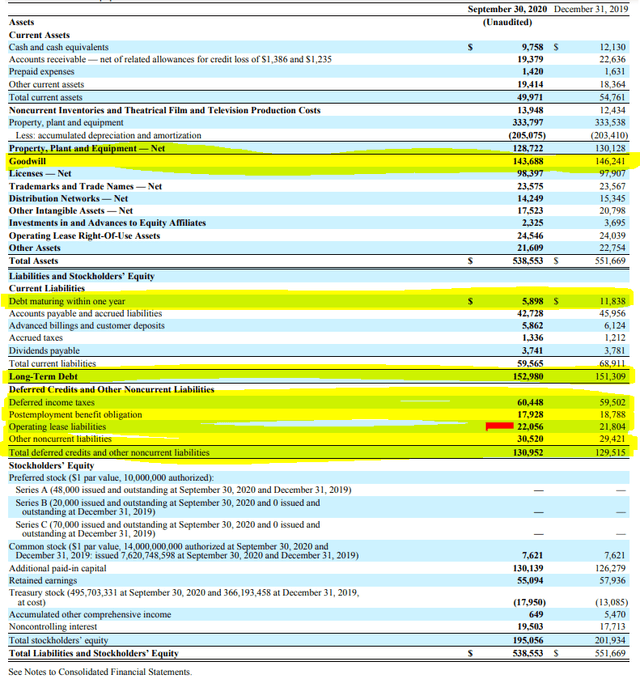

We treat the excess amount Cash and cash equivalents include all highly liquid investments with original maturities of three months or less. 2 Free cash flow is a non-GAAP financial measure that is used by investors and credit rating agencies to provide relevant and useful information. Free cash flow is cash from operating activities minus capital expenditures.

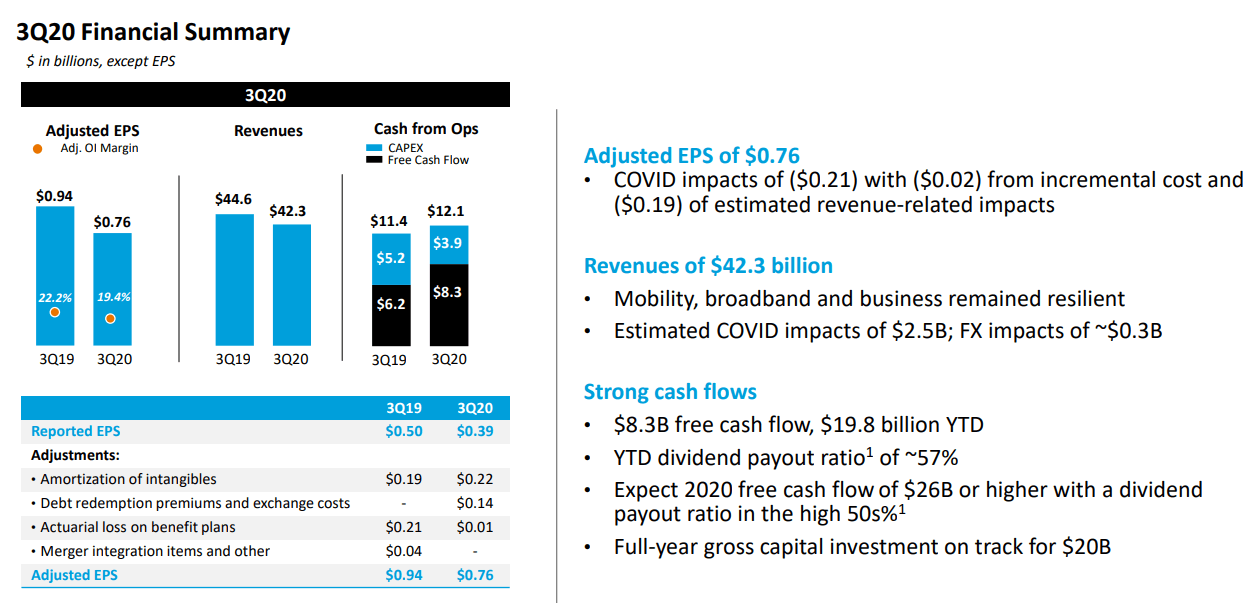

10B cash on hand at end of 4Q20 075 7 2021 ATT Intellectual Property. The cash flow statement is a summary of the cash inflows and outflows for a business over a given period of time. ATT Inc consolidated cash flow statement.

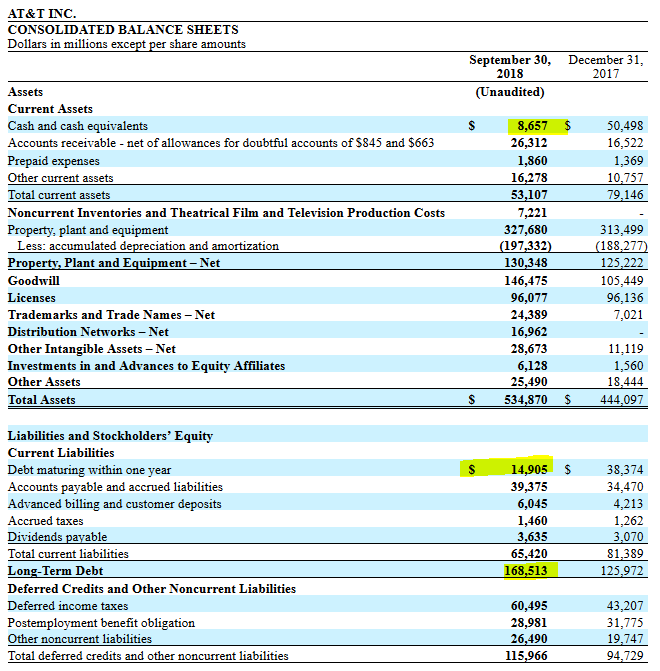

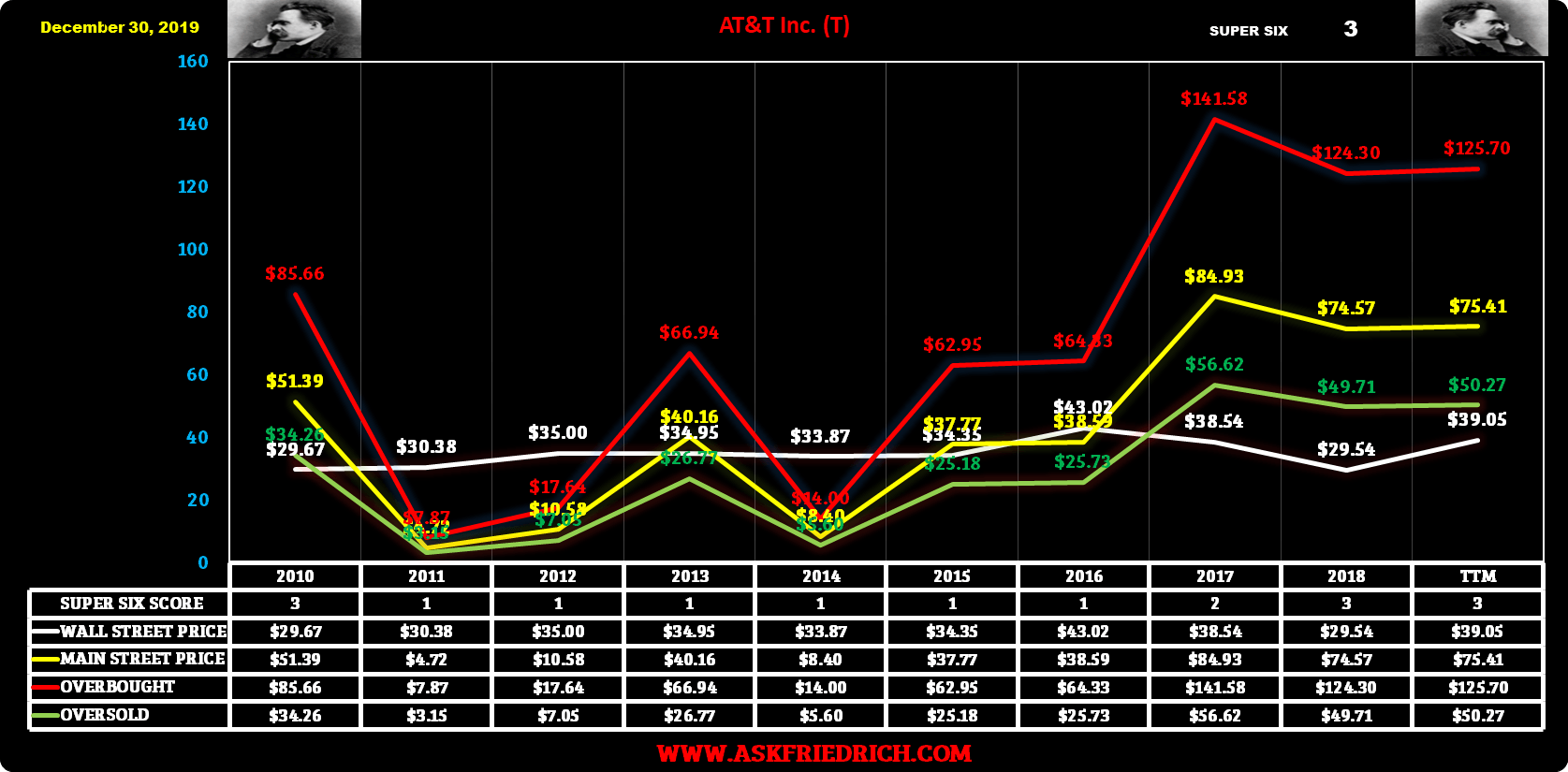

The carrying amounts approximate fair value. At December 31 2017 we held 4156 in cash and 46342 in money market funds and other cash equivalents. ATT annual free cash flow for 2020 was 27455B a 544 decline from 2019.

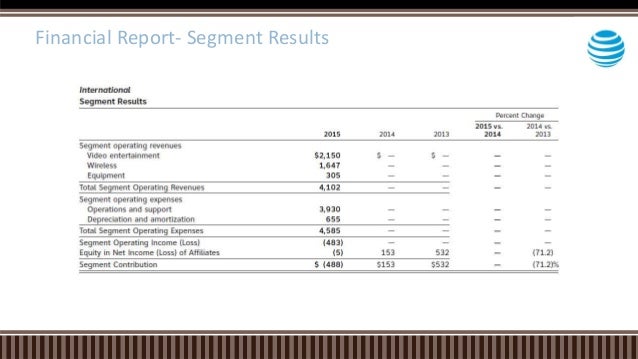

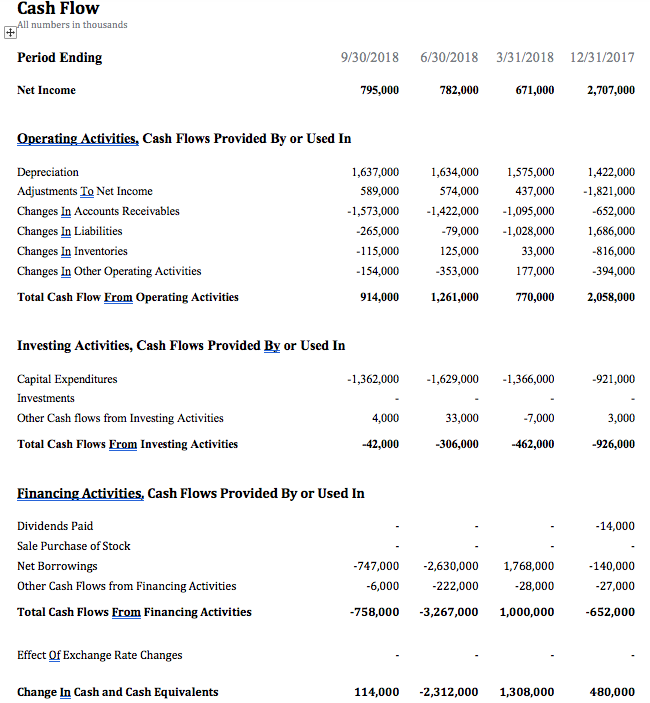

Focus on All Regions Focus on Developed Asia. Annual cash flow and in depth look at T operating investing and financing activities. ATT Incs net cash used in investing activities increased from Q3 2020 to Q4 2020 but then decreased significantly from Q4 2020 to Q1 2021.

The cash flows are grouped into three main categories. Cash flows provided by used in operating activities cash flows provided by used in investing activities and cash flows provided by used in financing activities. 1 The company also continues to expect gross capital investment in the 20 billion range for 2020.