Matchless Depreciation In Trial Balance

The accounts reflected on a trial balance are related to all major accounting Accounting Accounting is a term that describes the process of consolidating financial information to make it clear and understandable for all items including assets Types of Assets Common types of assets include current non-current physical intangible operating and non-operating.

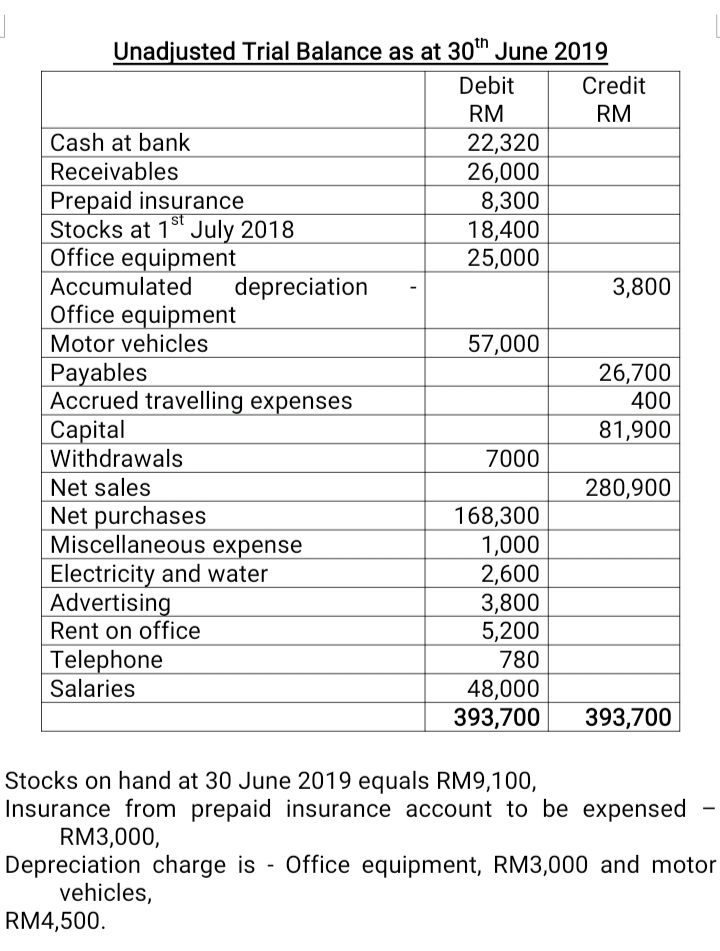

Depreciation in trial balance. The purpose of depreciation is to allocate the cost of a fixed or tangible asset over its useful life. In this chapter we will bring together the material from theprevious chapters and produce a set of financial statements from a trialbalance. From the following trial balance of Ms Kaushal Traders prepare Trading and Profit and Loss Account for the year ended 31 st March 2012 and a Balance Sheet as on that date.

Over time accumulated depreciation accounts increase until it nears the original cost of. Fixed assets like property plant and equipment are long-term assets. Accumulated depreciation is nothing but the sum total of depreciation charged until a specified date.

Upvote 1 Downvote 0 Reply 0 Answer added by manaf almas Auditor DAR AL NUZUM PUBLIC. Depreciation is the gradual charging to expense of an assets cost over its expected useful life. Using depreciation allows you to avoid incurring a large expense in a single accounting.

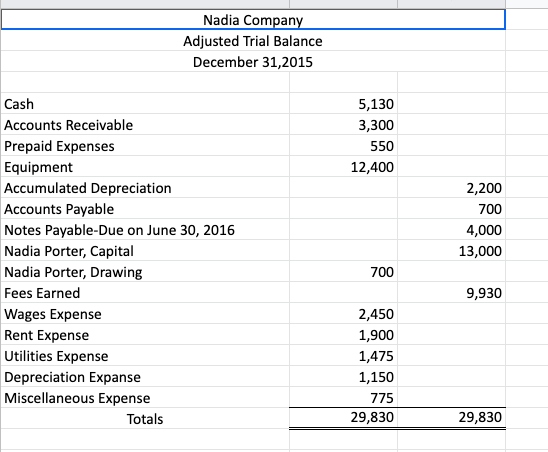

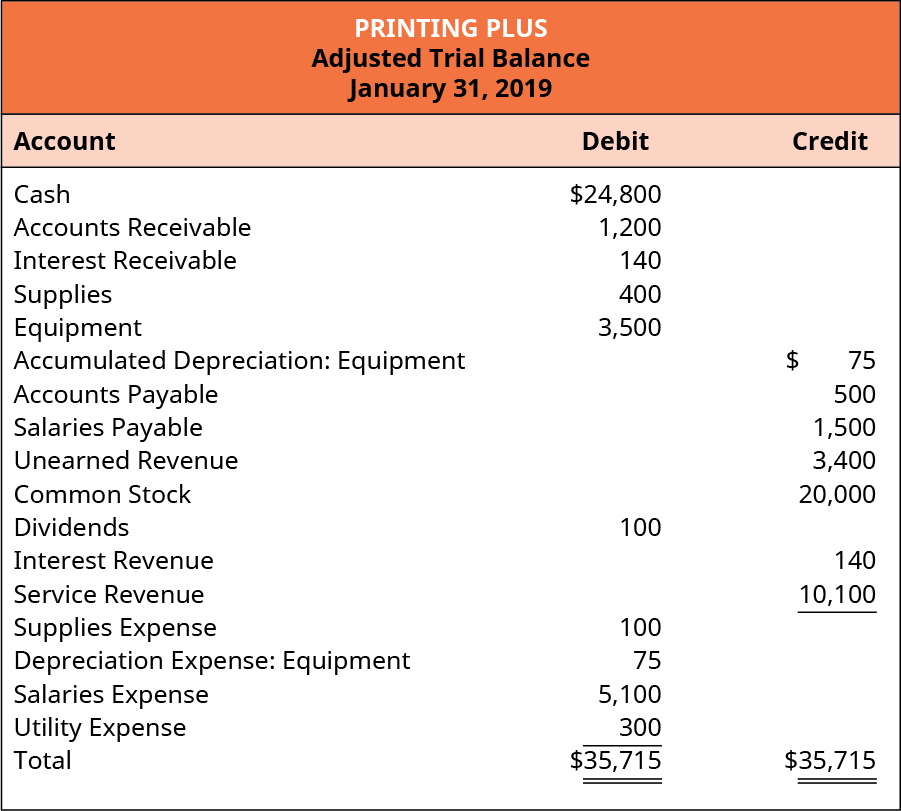

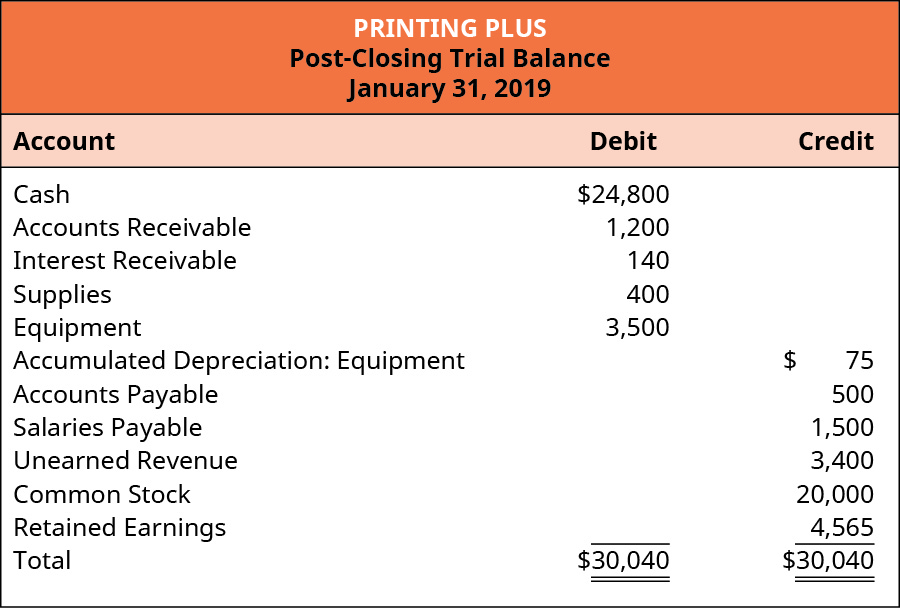

Such types of transactions are deposits closing stocks depreciation etc. Depreciation is an expense like any other expense of the business. Adjusted Trial Balance Example.

Accumulated Depreciation in a Trial Balance. CREDIT IN THE BALANCE TRIAL AND NOT DEDUCTED FROM ASSET IN THE BALANCE TRAIL IT DEDUCTED IN THE BALANCE SHEET. When the depreciation is provided in the books by creating a depreciation provision account following entry will be passed.

The reducing balance method of depreciation is most useful when an asset has higher utility or productivity at the start of its useful life as it results in depreciation expenses that reflect the assets productivity functionality and capacity to generate revenue. All the liabilities and provisions account are always having a credit balance. Once all necessary adjustments are made a new second trial balance is prepared to ensure that it is still balanced.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)