Outstanding Check Company Balance Sheet

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

It is the report card of the.

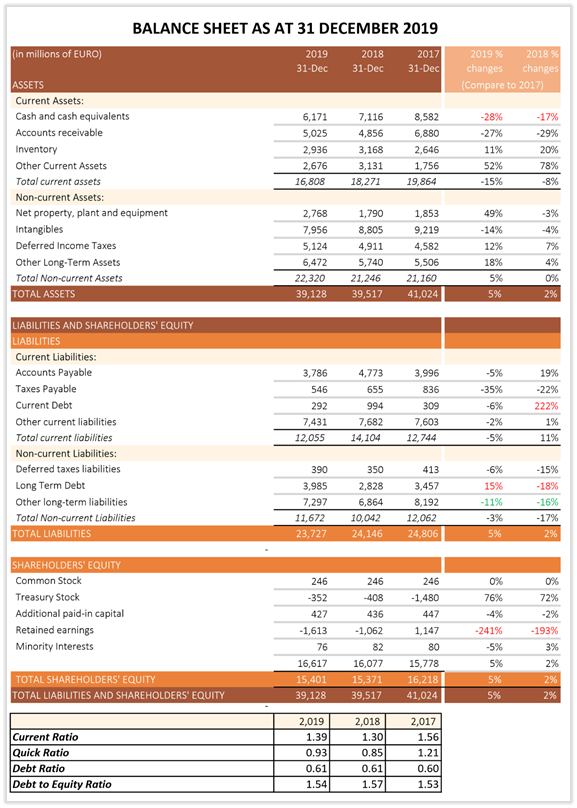

Check company balance sheet. It records the assets and liabilities of the business at the end of the accounting period after the preparation of trading and profit and loss accounts. On the Asset Side Amount of Cash Balance - to know if the company has enough liquidity to meet its liabilities. A balance sheet is simply a financial statement that summarizes an organizations assets liabilities and shareholders equity.

Assets or the value of what the company has owns or is owed. If you want to download the balancesheet then choose Annual return Balance sheet eforms. The sum of these items is the total of your companys current liabilities.

The balance sheet is a measure of the solvency of the business. It gives us the information on the asset liability and shareholders equity on a particular day. The balance sheet is divided into three segments.

This is why it can be useful to check balance sheets from prior years in order to spot material changes. Assets Liabilities Shareholders Equity This means that assets or the means used to operate the company are balanced by a companys financial. On a very basic level an investor will usually check the following items of the Balance Sheet.

A balance sheet lists the value of all of a companys assets liabilities and shareholders or owners equity. A balance sheet gives a snapshot of your financials at a particular moment incorporating every journal entry since your company launched. The format is based upon the accounting equation.

Be warned though that these only show the state of a company right now. A balance sheet is a financial statement that communicates the so-called book value of an organization as calculated by subtracting all of the companys liabilities and shareholder equity from its. It shows what your business owns assets what it owes liabilities and what money is left over for the owners owners equity.