Outrageous Cash Flow Statement Ifrs 16

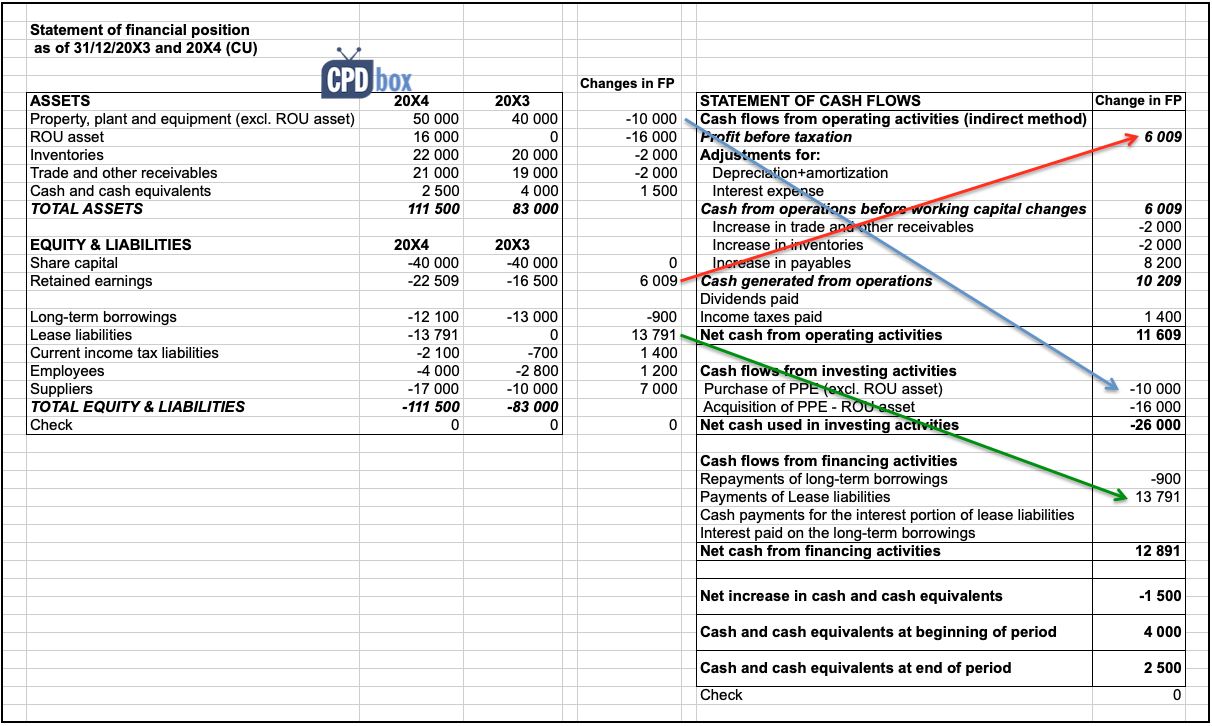

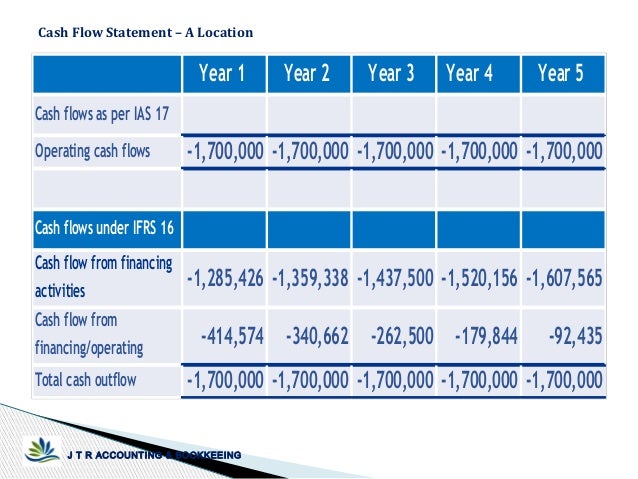

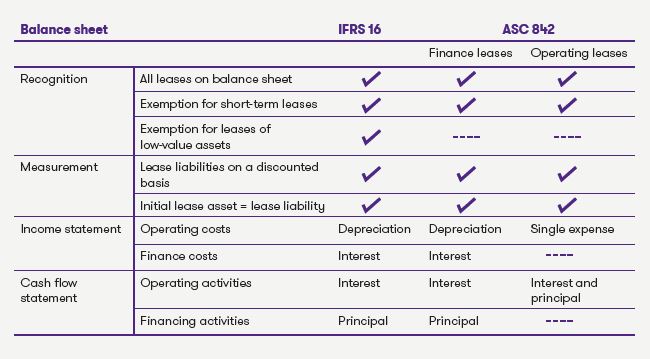

Repayments of the principal portion of the lease liability are presented within financing activities.

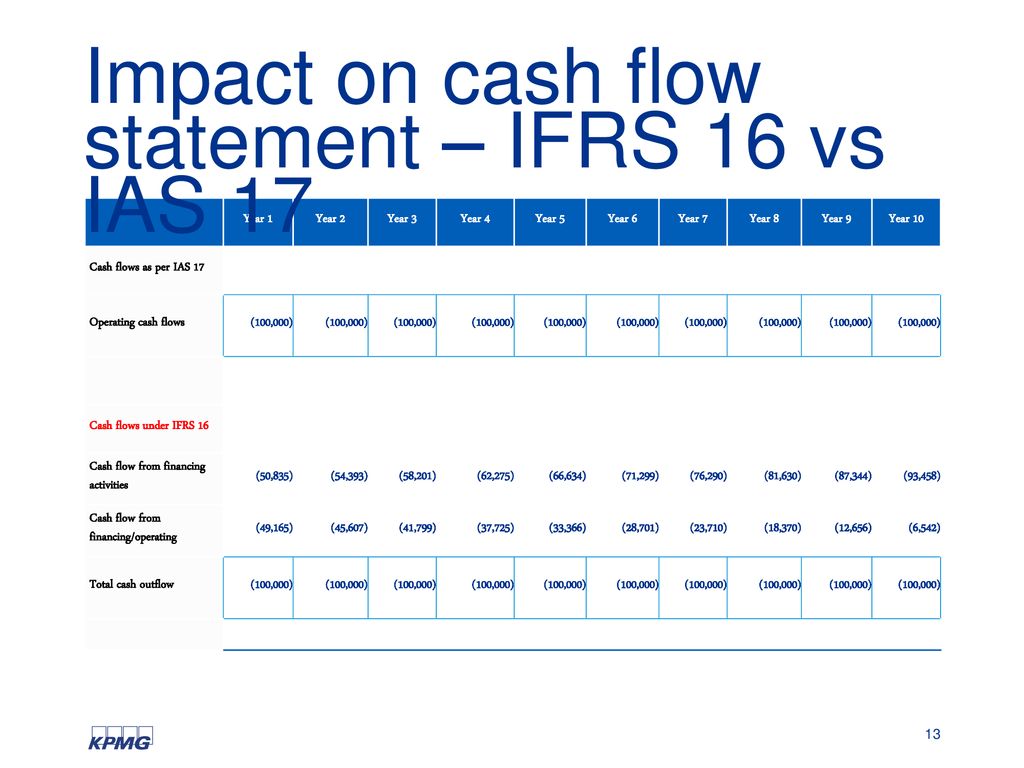

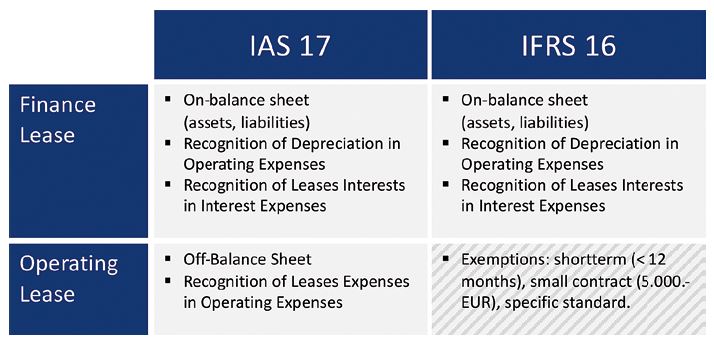

Cash flow statement ifrs 16. Total cash outflow for leases. As operating type ie. Off balance sheet from the perspective of lessees with their respective cash flows included in operating activities.

The cashflow from investing activities does not change materially due to IFRS 16 in this case the CAPEX can be taken directly from the cash flow statement at -2040m EUR. IFRS 16 requires most leases to be recorded on balance sheet and therefore cash outflows arising from financing activities will generally increase due to IFRS 16. The details are as follows.

IFRS 16 is effective for annual reporting periods beginning on or after 1 January 2019 with earlier application permitted as long as IFRS 15 is also applied. This means that net cash flows will not change but metrics like operating cash flow and free cash flow will increase for a company with a large portfolio of leases. As such this supplement is not intended to reconcile to that guide.

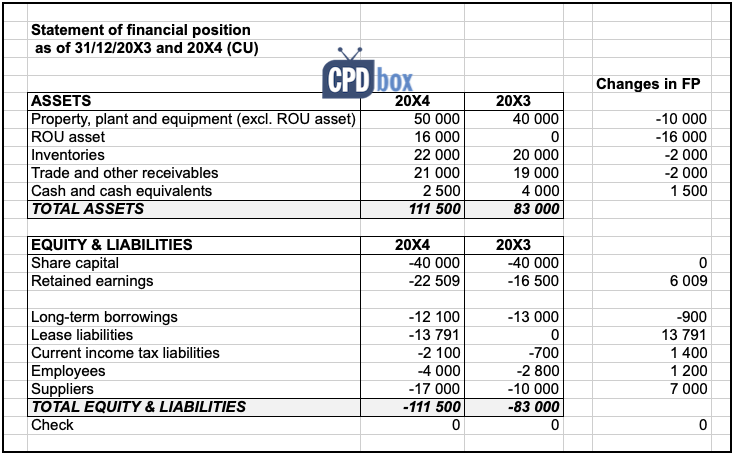

IFRS 1653 Relating to the statement of cash flows Total cash outflow for leases IFRS 1655 Other Amount of short-term lease commitments if current short-term lease expense is not representative for the following year IFRS 1658 60 Qualitative disclosures Description of how liquidity risk related to lease liabilities is managed. Statement of cash flows. Amount of short-term lease commitments if current short-term lease expense is not representative for the following year.

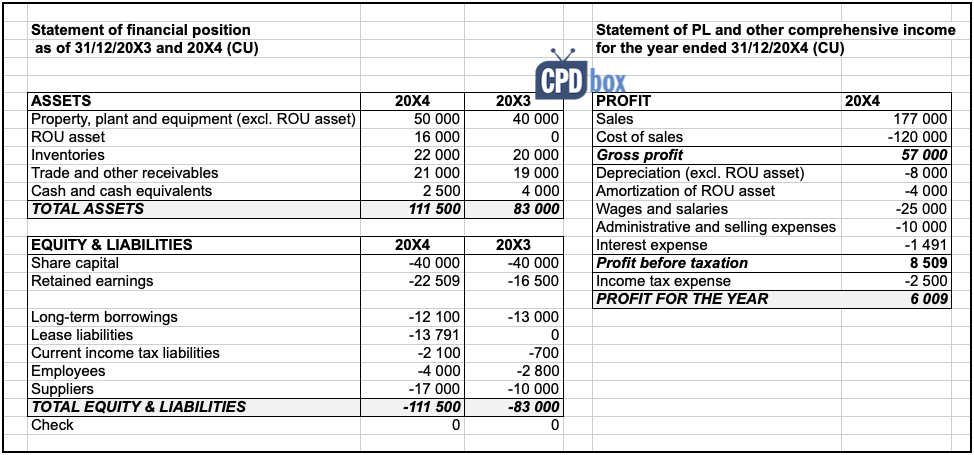

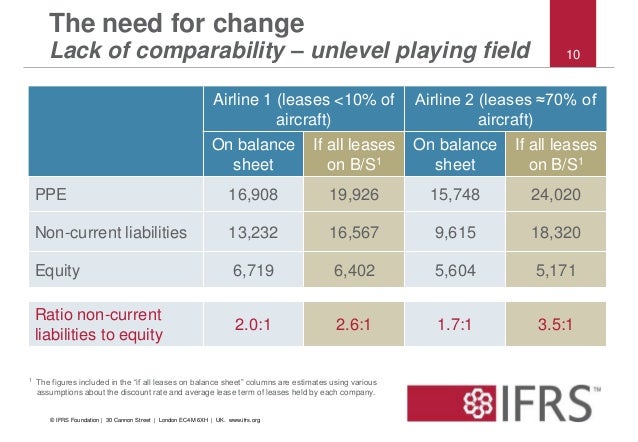

New Standard for Leases The International Financial Reporting Standards body IFRS 16 has drawn up revised rules regarding the recognition of operating leases in the balance sheet. In contrast IFRS 16 includes specific requirements for the presentation of the ROU asset and lease liability and the corresponding effects on the results and cash flows in the primary financial statements. Relating to the statement of cash flows.

Initial right-of-use asset equals to CU 20 000 thereof. Under IFRS 16 7 a lessee classifies cash payments for the principal portion of a lease liability as financing activities in the statement of cash flows. Follow IFRS 16 classification and treat lease payments as cash flows to debt providers in the discounted cash flow model and subtract the fair value the lease liability from the outcome as applicable.