Top Notch Describe Balance Sheet

The balance sheet summarizes a businesss assets liabilities and shareholders equity.

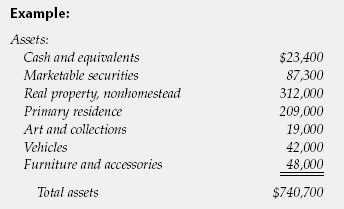

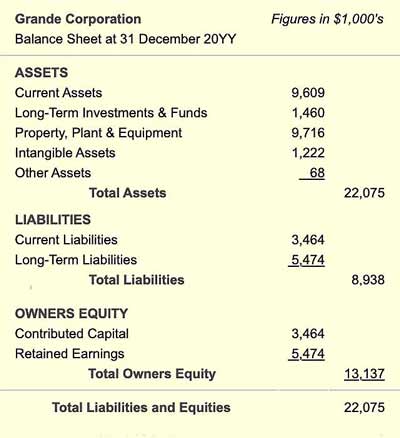

Describe balance sheet. As the term balance sheet suggests it is a tabular sheet of balances of assets liabilities and equity. It records the assets and liabilities of the business at the end of the accounting period after the preparation of trading and profit and loss accounts. The balance sheet is so named because the two sides of the balance sheet ALWAYS add up to the same amount.

A balance sheet is a financial statement that reports a companys assets liabilities and shareholders equity. This one unbreakable balance sheet formula is always always true. The balance sheet together.

A firms liabilities and shareholders equity are thought of as the elements needed to acquire assets. The accounting equation also commonly referred to as the balance sheet equation is a formula used in double-entry accounting that shows the relationship between your assets liabilities and equity. This statement shows the entitys financial position at the point of time.

The balance sheet is one of the three income statement and statement of cash flows. Updated Feb 20 2021 A companys balance sheet also known as a statement of financial position reveals the firms assets liabilities and owners equity net worth. The balance sheet is one of the most important elements of financial statements.

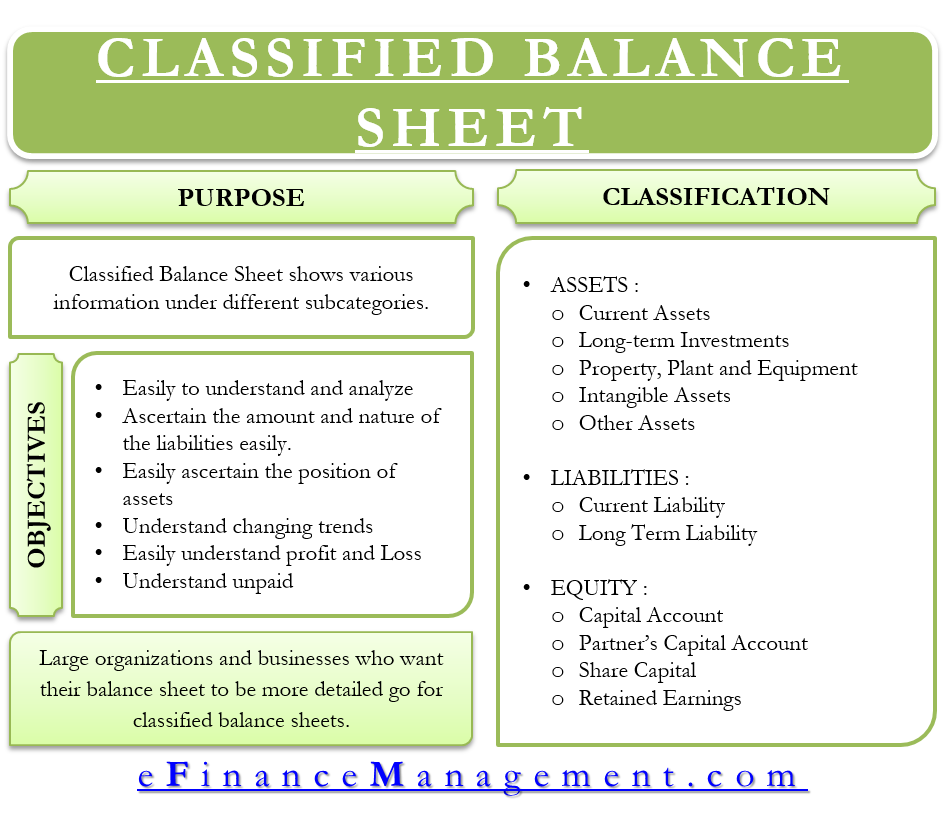

What is a Balance Sheet. The balance sheet is sometimes called the statement of financial position. What we mean by financial position is that this statement tells us how the entitys assets liabilities as well equity are at a specific time frame.

It captures the financial position of a company at a particular point in time. In other words the balance sheet illustrates a businesss net worth. Liabilities are generally further classified into current and long-term liabilities.

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)