Top Notch Subsequent Event Note Disclosure Example

The examples are classified according to the type of event that resulted in adjustment.

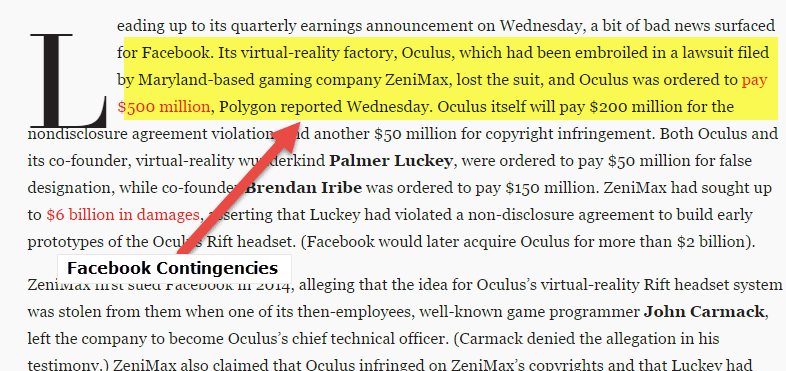

Subsequent event note disclosure example. Settlement of litigation when the event giving rise to the claim tookplace subsequent to the balance-sheet date. These illustrative notes are a sample of what the Board may wish to disclose. There are two types of subsequent events.

Measures taken by various governments to contain the virus have affected economic activity. Notes to the Financial Statements for the financial year ended 31 December 2005 These notes form an integral part of and should be read in conjunction with the accompanying financial statements. Managements plans to deal with the effects of the COVID-19 outbreak and whether there is material uncertainty over the entitys ability to continue as a going concern breaches of covenants waivers or modifications of contractual terms in lending arrangements.

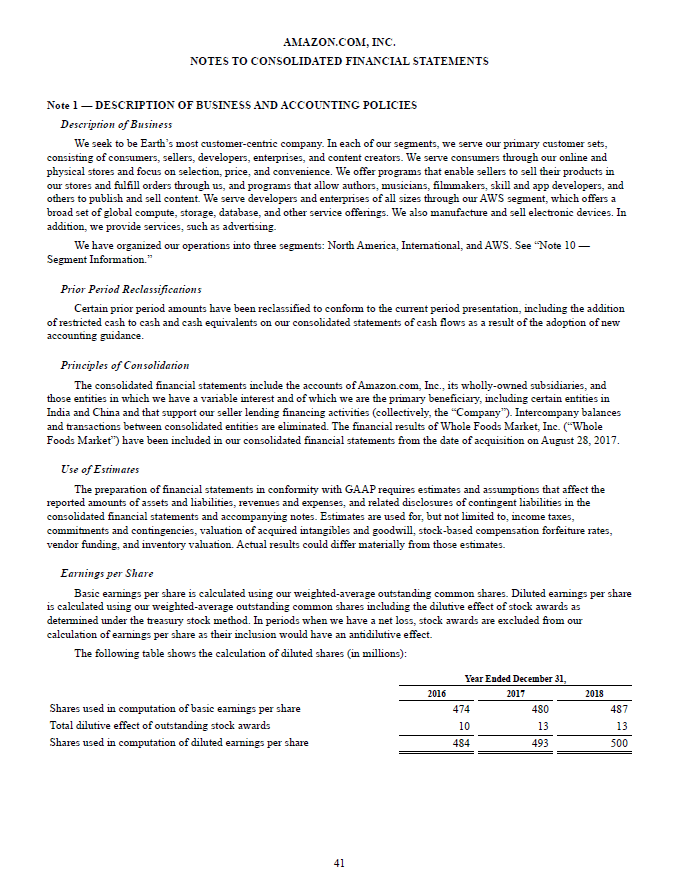

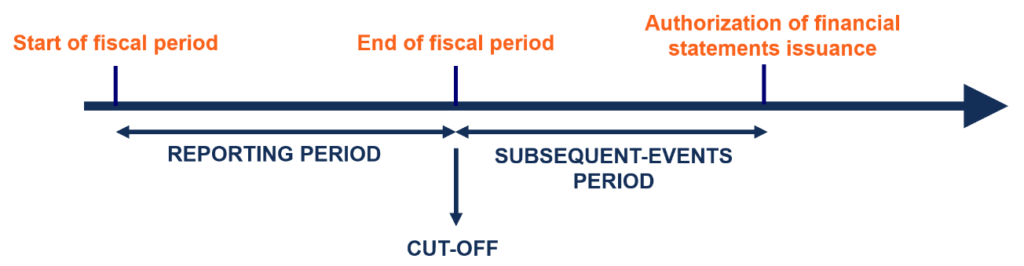

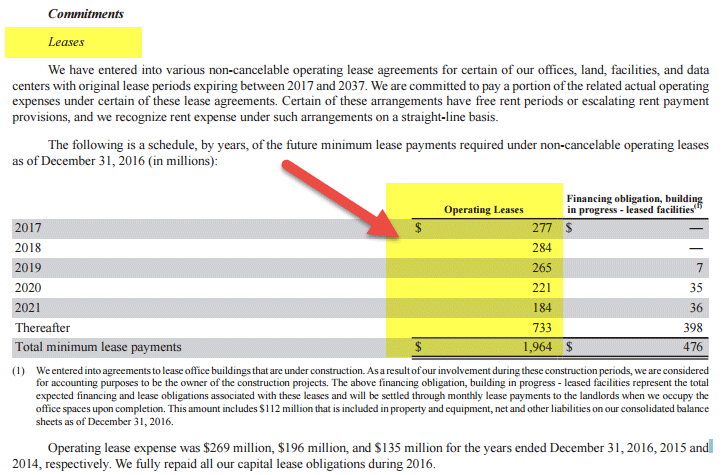

Events that occur between the end of the period covered by the financial statements 0831CY and the statement completion date 1120CY that may materially affect the financial condition of the agency are considered subsequent events. Per the Financial Accounting Standards Board FASB Accounting Standards Codification ASC 855-10-20 Subsequent Events are defined as events or transactions that occur after the balance sheet date but before financial statements are issued or are available to be issued. The following events and transactions occurred subsequent to December 31 20XX.

However a subsequent event footnote disclosure should be made so that investors know the event occurred. They are provided to aid the sector in the preparation of the financial statements. Sample Disclosure Results of Operations.

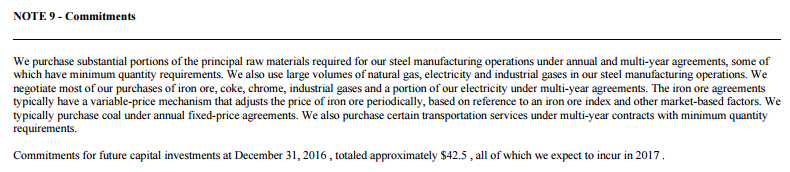

If your agency has any subsequent events provide sufficient detail in note disclosures. Completion of Acquisitions of Assets. The detail and location of such disclosure should depend on the extent to which the entity is affected.

Purchase of a business. SUBSEQUENT EVENTS RESULTING IN ADJUSTMENT OF THE FINANCIAL STATEMENTS Twenty-three examples are presented of the disclosure of subsequent events that resulted in adjustment of the financial statements covering the period ending before the occurrence of the event. Our tax rate is affected by recurring items such as tax rates in foreign jurisdictions and the relative.