Cool Maruti Suzuki Financial Ratios

The EVEBITDA NTM ratio of Maruti Suzuki India Limited is significantly higher than the average of its sector Automobiles.

Maruti suzuki financial ratios. Financial Charges Coverage Ratio Post Tax. Diluted EPS Rs 145. Established in February 1981 though the actual production commenced in 1983 with the Maruti 800 based on Suzuki alto kei.

Maruti Udyog Limited was renamed as. 324 Cash Earnings Retention Ratio CASH EARNING RETENTION MARUTI SUZUKI TATA MOTORS RATIO 2019 7703 0 2018 7839 0 2017 8938 0 2016 9078 0 2015 8779 0 y 3391x 74501 Cash earning Ratio R² 06883 94 92 90 88 86 84 82 80 78 76 0 1 2 3 4 5 6 Anova. From an investors perspective ROE is a key ratio.

Operating Margin 1015. Charges CovRatio Post Tax 7304. Earnings Per Share Rs 18795.

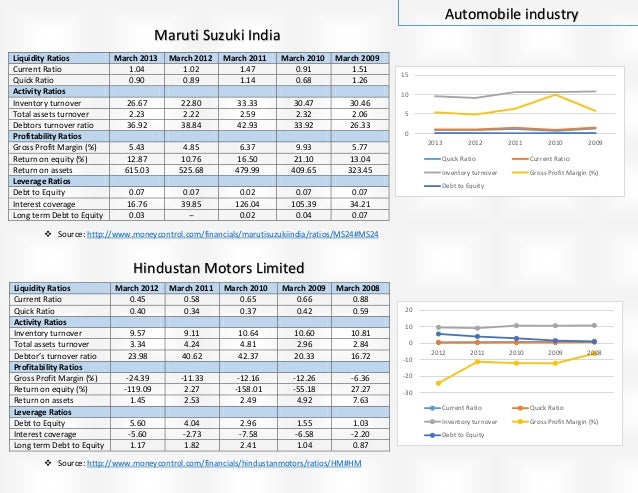

Dividend payout ratio cash profit 2633. Average 2 year ROE of Maruti Suzuki India Ltd. NOW WE ARE ANALYSING RATIOS OF MARUTI SUZUKI IN REFERECE TO ABOVE MENTION BALANCE SHEET AND PL AC LIQUIDITY RATIOS.

Basic EPS Rs 14002. This means that Maruti is best equipped to pay off its short term debt obligations. Per Share Ratios.

Per Share Ratios. Basic EPS Rs 14530. Single Factor Groups Count Sum Average Variance CASH EARNING RETENTION RATIO 5 10085 2017 25 MARUTI SUZUKI.